Form 3614 - Preservation Tax Credit Assignment

ADVERTISEMENT

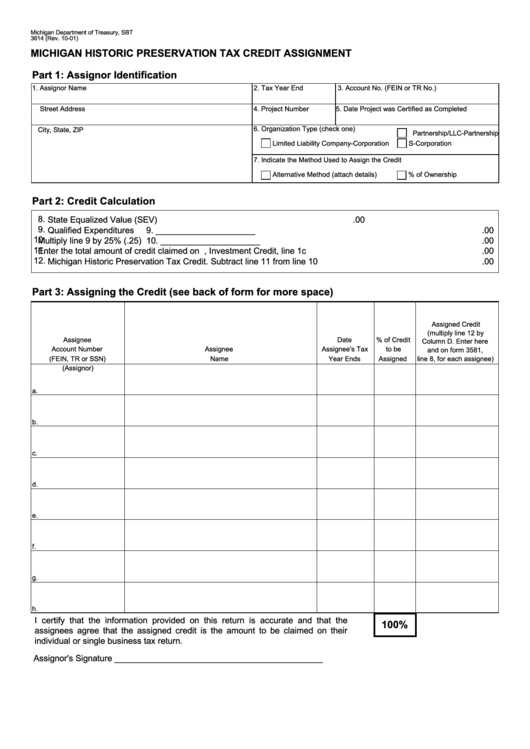

Michigan Department of Treasury, SBT

3614 (Rev. 10-01)

MICHIGAN HISTORIC PRESERVATION TAX CREDIT ASSIGNMENT

Part 1: Assignor Identification

1. Assignor Name

2. Tax Year End

3. Account No. (FEIN or TR No.)

Street Address

4. Project Number

5. Date Project was Certified as Completed

6. Organization Type (check one)

City, State, ZIP

Partnership/LLC-Partnership

Limited Liability Company-Corporation

S-Corporation

7. Indicate the Method Used to Assign the Credit

Alternative Method (attach details)

% of Ownership

Part 2: Credit Calculation

8.

State Equalized Value (SEV) ......................................... 8. ____________________

.00

9.

Qualified Expenditures .................................................................................................... 9. _____________________

.00

10.

Multiply line 9 by 25% (.25) ............................................................................................. 10. _____________________

.00

11.

Enter the total amount of credit claimed on U.S. 3468, Investment Credit, line 1c ....... 11. _____________________

.00

12.

Michigan Historic Preservation Tax Credit. Subtract line 11 from line 10 ....................... 12. _____________________

.00

Part 3: Assigning the Credit (see back of form for more space)

A.

B.

C.

D.

E.

Assigned Credit

(multiply line 12 by

Assignee

Date

% of Credit

Column D. Enter here

Account Number

Assignee

Assignee's Tax

to be

and on form 3581,

(FEIN, TR or SSN)

Name

Year Ends

Assigned

line 8, for each assignee)

(Assignor)

a.

b.

c.

d.

e.

f.

g.

h.

I certify that the information provided on this return is accurate and that the

100%

assignees agree that the assigned credit is the amount to be claimed on their

individual or single business tax return.

Assignor's Signature ____________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4