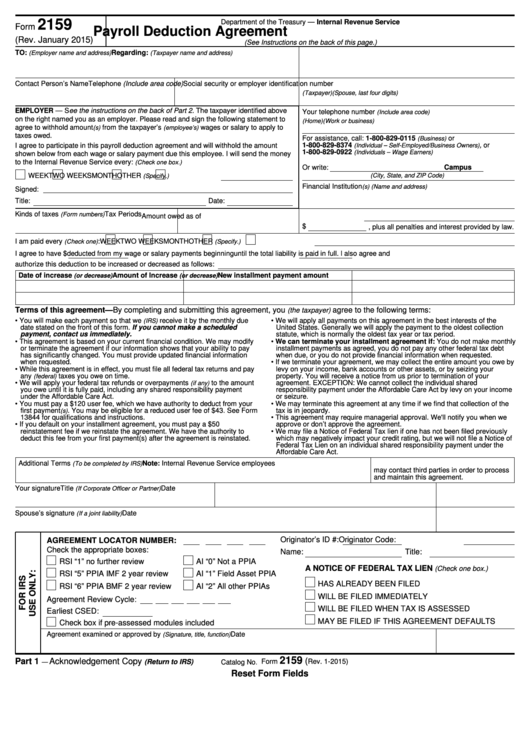

2159

Department of the Treasury — Internal Revenue Service

Form

Payroll Deduction Agreement

(Rev. January 2015)

(See Instructions on the back of this page.)

TO:

Regarding:

(Employer name and address)

(Taxpayer name and address)

Contact Person’s Name

Telephone (Include area code)

Social security or employer identification number

(Taxpayer)

(Spouse, last four digits)

EMPLOYER — See the instructions on the back of Part 2. The taxpayer identified above

Your telephone number

(Include area code)

on the right named you as an employer. Please read and sign the following statement to

(Home)

(Work or business)

agree to withhold amount

from the taxpayer’s

wages or salary to apply to

(s)

(employee’s)

taxes owed.

For assistance, call: 1-800-829-0115

or

(Business)

1-800-829-8374

, or

I agree to participate in this payroll deduction agreement and will withhold the amount

(Individual – Self-Employed/Business Owners)

1-800-829-0922

(Individuals – Wage Earners)

shown below from each wage or salary payment due this employee. I will send the money

to the Internal Revenue Service every:

(Check one box.)

Or write:

Campus

WEEK

TWO WEEKS

MONTH

OTHER

(City, State, and ZIP Code)

(Specify.)

Financial Institution

(s) (Name and address)

Signed:

Title:

Date:

Kinds of taxes

Tax Periods

(Form numbers)

Amount owed as of

$

, plus all penalties and interest provided by law.

I am paid every

:

WEEK

TWO WEEKS

MONTH

OTHER

(Check one)

(Specify.)

I agree to have $

deducted from my wage or salary payments beginning

until the total liability is paid in full. l also agree and

authorize this deduction to be increased or decreased as follows:

Date of increase

Amount of Increase

New installment payment amount

(or decrease)

(or decrease)

Terms of this agreement—By completing and submitting this agreement, you

agree to the following terms:

(the taxpayer)

• You will make each payment so that we

receive it by the monthly due

• We will apply all payments on this agreement in the best interests of the

(IRS)

date stated on the front of this form. If you cannot make a scheduled

United States. Generally we will apply the payment to the oldest collection

payment, contact us immediately.

statute, which is normally the oldest tax year or tax period.

• This agreement is based on your current financial condition. We may modify

• We can terminate your installment agreement if: You do not make monthly

or terminate the agreement if our information shows that your ability to pay

installment payments as agreed, you do not pay any other federal tax debt

has significantly changed. You must provide updated financial information

when due, or you do not provide financial information when requested.

when requested.

• If we terminate your agreement, we may collect the entire amount you owe by

• While this agreement is in effect, you must file all federal tax returns and pay

levy on your income, bank accounts or other assets, or by seizing your

any

taxes you owe on time.

property. You will receive a notice from us prior to termination of your

(federal)

• We will apply your federal tax refunds or overpayments

to the amount

agreement. EXCEPTION: We cannot collect the individual shared

(if any)

you owe until it is fully paid, including any shared responsibility payment

responsibility payment under the Affordable Care Act by levy on your income

under the Affordable Care Act.

or seizure.

• You must pay a $120 user fee, which we have authority to deduct from your

• We may terminate this agreement at any time if we find that collection of the

first payment

. You may be eligible for a reduced user fee of $43. See Form

tax is in jeopardy.

(s)

13844 for qualifications and instructions.

• This agreement may require managerial approval. We'll notify you when we

• If you default on your installment agreement, you must pay a $50

approve or don’t approve the agreement.

reinstatement fee if we reinstate the agreement. We have the authority to

• We may file a Notice of Federal Tax lien if one has not been filed previously

deduct this fee from your first payment(s) after the agreement is reinstated.

which may negatively impact your credit rating, but we will not file a Notice of

Federal Tax Lien on an individual shared responsibility payment under the

Affordable Care Act.

Additional Terms

Note: Internal Revenue Service employees

(To be completed by IRS)

may contact third parties in order to process

and maintain this agreement.

Your signature

Title

Date

(If Corporate Officer or Partner)

Spouse’s signature

Date

(If a joint liability)

Originator’s ID #:

Originator Code:

AGREEMENT LOCATOR NUMBER:

Check the appropriate boxes:

Name:

Title:

RSI “1” no further review

AI “0” Not a PPIA

A NOTICE OF FEDERAL TAX LIEN

(Check one box.)

RSI “5” PPIA IMF 2 year review

AI “1” Field Asset PPIA

HAS ALREADY BEEN FILED

RSI “6” PPIA BMF 2 year review

AI “2” All other PPIAs

WILL BE FILED IMMEDIATELY

Agreement Review Cycle:

WILL BE FILED WHEN TAX IS ASSESSED

Earliest CSED:

MAY BE FILED IF THIS AGREEMENT DEFAULTS

Check box if pre-assessed modules included

Agreement examined or approved by

Date

(Signature, title, function)

2159

(

Part 1

Acknowledgement Copy

(Return to IRS)

Form

Rev. 1-2015)

—

Catalog No. 21475H

Reset Form Fields

1

1 2

2 3

3 4

4 5

5 6

6