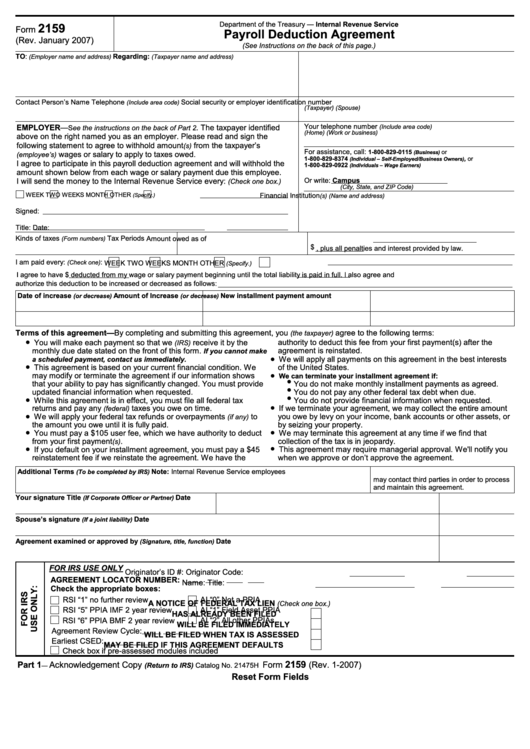

Department of the Treasury — Internal Revenue Service

2159

Form

Payroll Deduction Agreement

(Rev. January 2007)

(See Instructions on the back of this page.)

TO:

Regarding:

(Employer name and address)

(Taxpayer name and address)

Contact Person’s Name

Telephone

Social security or employer identification number

(Include area code)

(Taxpayer)

(Spouse)

Your telephone number

EMPLOYER—

. The taxpayer identified

(Include area code)

See the instructions on the back of Part 2

(Home)

(Work or business)

above on the right named you as an employer. Please read and sign the

following statement to agree to withhold amount

from the taxpayer’s

(s)

For assistance, call:

1-800-829-0115

or

(Business)

wages or salary to apply to taxes owed.

(employee’s)

1-800-829-8374

, or

(Individual – Self-Employed/Business Owners)

I agree to participate in this payroll deduction agreement and will withhold the

1-800-829-0922

(Individuals – Wage Earners)

amount shown below from each wage or salary payment due this employee.

I will send the money to the Internal Revenue Service every:

Or write:

Campus

(Check one box.)

(City, State, and ZIP Code)

WEEK

TWO WEEKS

MONTH

OTHER

Financial Institution

(Specify.)

(s) (Name and address)

Signed:

Title:

Date:

Kinds of taxes

Tax Periods

Amount owed as of

(Form numbers)

$

, plus all penalties and interest provided by law.

I am paid every:

:

WEEK

TWO WEEKS

MONTH

OTHER

(Check one)

(Specify.)

I agree to have $

deducted from my wage or salary payment beginning

until the total liability is paid in full. l also agree and

authorize this deduction to be increased or decreased as follows:

Date of increase

Amount of Increase

New installment payment amount

(or decrease)

(or decrease)

Terms of this agreement—By completing and submitting this agreement, you

agree to the following terms:

(the taxpayer)

•

You will make each payment so that we

receive it by the

authority to deduct this fee from your first payment(s) after the

(IRS)

monthly due date stated on the front of this form.

agreement is reinstated.

If you cannot make

•

We will apply all payments on this agreement in the best interests

a scheduled payment, contact us immediately.

•

This agreement is based on your current financial condition. We

of the United States.

•

may modify or terminate the agreement if our information shows

We can terminate your installment agreement if:

•

that your ability to pay has significantly changed. You must provide

You do not make monthly installment payments as agreed.

•

updated financial information when requested.

You do not pay any other federal tax debt when due.

•

•

While this agreement is in effect, you must file all federal tax

You do not provide financial information when requested.

•

returns and pay any

taxes you owe on time.

If we terminate your agreement, we may collect the entire amount

(federal)

•

We will apply your federal tax refunds or overpayments

to

you owe by levy on your income, bank accounts or other assets, or

(if any)

the amount you owe until it is fully paid.

by seizing your property.

•

•

You must pay a $105 user fee, which we have authority to deduct

We may terminate this agreement at any time if we find that

from your first payment

.

collection of the tax is in jeopardy.

(s)

•

•

If you default on your installment agreement, you must pay a $45

This agreement may require managerial approval. We'll notify you

reinstatement fee if we reinstate the agreement. We have the

when we approve or don’t approve the agreement.

Additional Terms

Note: Internal Revenue Service employees

(To be completed by IRS)

may contact third parties in order to process

and maintain this agreement.

Your signature

Title

Date

(If Corporate Officer or Partner)

Spouse’s signature

Date

(If a joint liability)

Agreement examined or approved by

Date

(Signature, title, function)

FOR IRS USE ONLY

Originator’s ID #:

Originator Code:

AGREEMENT LOCATOR NUMBER:

Name:

Title:

Check the appropriate boxes:

RSI “1” no further review

AI “0” Not a PPIA

A NOTICE OF FEDERAL TAX LIEN

(Check one box.)

RSI “5” PPIA IMF 2 year review

AI “1” Field Asset PPIA

HAS ALREADY BEEN FILED

RSI “6” PPIA BMF 2 year review

AI “2” All other PPIAs

WILL BE FILED IMMEDIATELY

Agreement Review Cycle:

WILL BE FILED WHEN TAX IS ASSESSED

Earliest CSED:

MAY BE FILED IF THIS AGREEMENT DEFAULTS

Check box if pre-assessed modules included

2159

Part 1

Acknowledgement Copy

Form

(Rev. 1-2007)

(Return to IRS)

Catalog No. 21475H

—

Reset Form Fields

1

1 2

2 3

3 4

4 5

5 6

6