Form 207f - Affidavit And Instructions

ADVERTISEMENT

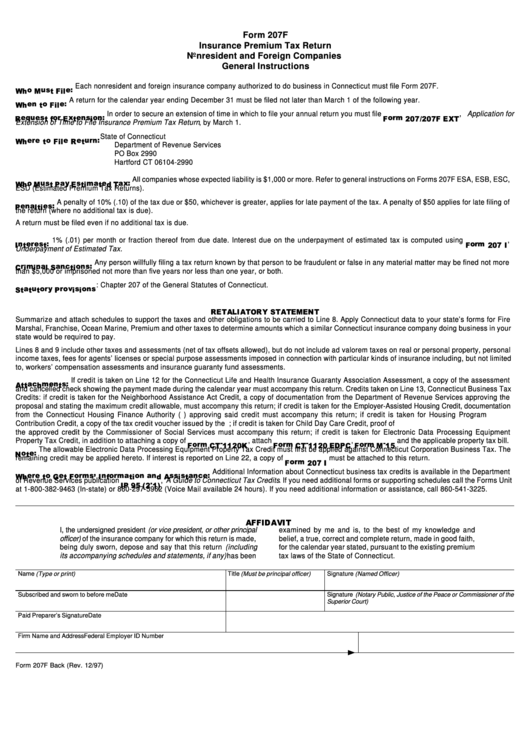

Form 207F

Insurance Premium Tax Return

Nonresident and Foreign Companies

General Instructions

Each nonresident and foreign insurance company authorized to do business in Connecticut must file Form 207F.

A return for the calendar year ending December 31 must be filed not later than March 1 of the following year.

In order to secure an extension of time in which to file your annual return you must file

, Application for

Extension of Time to File Insurance Premium Tax Return , by March 1.

State of Connecticut

Department of Revenue Services

PO Box 2990

Hartford CT 06104-2990

All companies whose expected liability is $1,000 or more. Refer to general instructions on Forms 207F ESA, ESB, ESC,

ESD (Estimated Premium Tax Returns).

A penalty of 10% (.10) of the tax due or $50, whichever is greater, applies for late payment of the tax. A penalty of $50 applies for late filing of

the return (where no additional tax is due).

A return must be filed even if no additional tax is due.

1% (.01) per month or fraction thereof from due date. Interest due on the underpayment of estimated tax is computed using

,

Underpayment of Estimated Tax.

Any person willfully filing a tax return known by that person to be fraudulent or false in any material matter may be fined not more

than $5,000 or imprisoned not more than five years nor less than one year, or both.

: Chapter 207 of the General Statutes of Connecticut.

Summarize and attach schedules to support the taxes and other obligations to be carried to Line 8. Apply Connecticut data to your state’s forms for Fire

Marshal, Franchise, Ocean Marine, Premium and other taxes to determine amounts which a similar Connecticut insurance company doing business in your

state would be required to pay.

Lines 8 and 9 include other taxes and assessments (net of tax offsets allowed), but do not include ad valorem taxes on real or personal property, personal

income taxes, fees for agents’ licenses or special purpose assessments imposed in connection with particular kinds of insurance including, but not limited

to, workers’ compensation assessments and insurance guaranty fund assessments.

If credit is taken on Line 12 for the Connecticut Life and Health Insurance Guaranty Association Assessment, a copy of the assessment

and cancelled check showing the payment made during the calendar year must accompany this return. Credits taken on Line 13, Connecticut Business Tax

Credits: if credit is taken for the Neighborhood Assistance Act Credit, a copy of documentation from the Department of Revenue Services approving the

proposal and stating the maximum credit allowable, must accompany this return; if credit is taken for the Employer-Assisted Housing Credit, documentation

from the Connecticut Housing Finance Authority (C.H.F.A.) approving said credit must accompany this return; if credit is taken for Housing Program

Contribution Credit, a copy of the tax credit voucher issued by the C.H.F.A. must accompany this return; if credit is taken for Child Day Care Credit, proof of

the approved credit by the Commissioner of Social Services must accompany this return; if credit is taken for Electronic Data Processing Equipment

Property Tax Credit, in addition to attaching a copy of

, attach

,

and the applicable property tax bill.

The allowable Electronic Data Processing Equipment Property Tax Credit must first be applied against Connecticut Corporation Business Tax. The

remaining credit may be applied hereto. If interest is reported on Line 22, a copy of

must be attached to this return.

Additional Information about Connecticut business tax credits is available in the Department

of Revenue Services publication

, A Guide to Connecticut Tax Credits . If you need additional forms or supporting schedules call the Forms Unit

at 1-800-382-9463 (In-state) or 860-297-5962 (Voice Mail available 24 hours). If you need additional information or assistance, call 860-541-3225.

I, the undersigned president (or vice president, or other principal

examined by me and is, to the best of my knowledge and

officer) of the insurance company for which this return is made,

belief, a true, correct and complete return, made in good faith,

being duly sworn, depose and say that this return (including

for the calendar year stated, pursuant to the existing premium

its accompanying schedules and statements, if any) has been

tax laws of the State of Connecticut.

Name (Type or print)

Title (Must be principal officer)

Signature (Named Officer)

Subscribed and sworn to before me

Date

Signature (Notary Public, Justice of the Peace or Commissioner of the

Superior Court)

Paid Preparer’s Signature

Date

Firm Name and Address

Federal Employer ID Number

Form 207F Back (Rev. 12/97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1