Form Nyc-210 , 2015, Instructions

ADVERTISEMENT

Click here

for notice about address change

NYC-210-I

Department of Taxation and Finance

Instructions for Form NYC-210

Claim for New York City School Tax Credit

General information

Married – You are married if, on the last day of 2015, you were married

and living together, or you were married and living apart, but not legally

Who qualifies

separated under a decree of divorce or separate maintenance.

To claim the New York City (NYC) school tax credit, you must have lived

Note: Married includes a marriage between same-sex spouses.

in NYC for all or part of 2015. However, you cannot claim this credit if

If your spouse died in 2015, you may file as married for that year. You

you can be claimed as a dependent on another taxpayer’s federal return.

cannot file as married for subsequent years unless you remarry.

If you qualify, we will compute the amount of your credit.

Should you file a combined claim or should you file a separate

Purpose of form

claim?

If you qualify for the NYC school tax credit and are not filing a tax

Married taxpayers should file a combined claim by marking an X in

return on Form IT-201 or IT-203 for 2015, use Form NYC-210 to claim

box b and completing lines 1 through 5 if they want to receive one credit

your NYC school tax credit. File your Form NYC-210 as soon as you

amount for their combined claim. If only one spouse is eligible for the

can after January 1, 2016. You must file your 2015 claim no later

credit, a combined claim may still be filed for the credit amount of the

than April 15, 2019. We will compute the amount of your credit.

eligible spouse. However, if married taxpayers want to receive separate

credit amounts for each eligible spouse, each spouse must file a

If you are filing a tax return, you will claim and compute your credit on

separate claim marking an X in box c and completing lines 1, 2, and 5.

your return; do not file Form NYC-210. File your New York State income

tax return as soon as you can after January 1, 2016, but no later than

Qualifying widow(er) with dependent child – You are a qualifying

April 18, 2016.

widow(er) with dependent child if you meet all of the following conditions:

– your spouse died in 2013 or 2014, and you did not remarry in 2013,

Filing Form NYC-210 for past years

2014, or 2015; and

If you qualified to file Form NYC-210 for past years but failed to do so,

– you have a child, adopted child, stepchild, or foster child who lived

you may still be able to receive a NYC school tax credit for those years.

in your home for all of 2015 and you could have claimed the child as

To determine if you can file Form NYC-210, see the table below:

a dependent if you filed a federal return (temporary absences, such

Year

Last date to file

as for school, vacation, or medical care count as time lived in your

home); and

2012

April 15, 2016

– you paid over half of the expenses of keeping up your home.

2013

April 17, 2017

2014

April 16, 2018

Complete lines 1, 2, and 5 if you are a qualifying widow(er) with

dependent child.

Filling in your claim form

Please print (use black ink only; no red or other color ink or pencils

Line instructions

please) or type all X marks and other entries in the boxes and spaces

Line 2 – Enter in the box the number of months you lived in NYC in

provided. Do not enter dashes or slashes.

2015. In determining the number of months, count any period of more

Please keep your name and address entries within the spaces provided.

than one-half month as a full month. Do not count any period of one-half

For example, your first name should not go past the vertical line

month or less.

separating it from your middle initial (MI), which has its own entry area.

Example: You lived in NYC from November 16 to December 31, 2015.

Foreign addresses – Enter the information in the following order: city,

You would not count November as a month lived in NYC, but you would

abbreviation for the province or state, postal code (follow the country’s

count December.

practice), and country. Do not abbreviate the country name.

Line 4 – Enter in the box the number of months your spouse lived in

You must enter your date(s) of birth and social security number(s)

NYC during 2015. If your spouse died during 2015 and lived in NYC from

in the boxes to the right of the name and address box. If married,

January 1, 2015, until time of death, enter 12 on line 4. If your spouse

be sure your dates of birth and social security numbers are in the same

moved into or out of NYC prior to his or her death, enter on line 4 the

order as your names.

number of months he or she lived in NYC during 2015.

Enter the county of residence in New York City that qualifies you for the

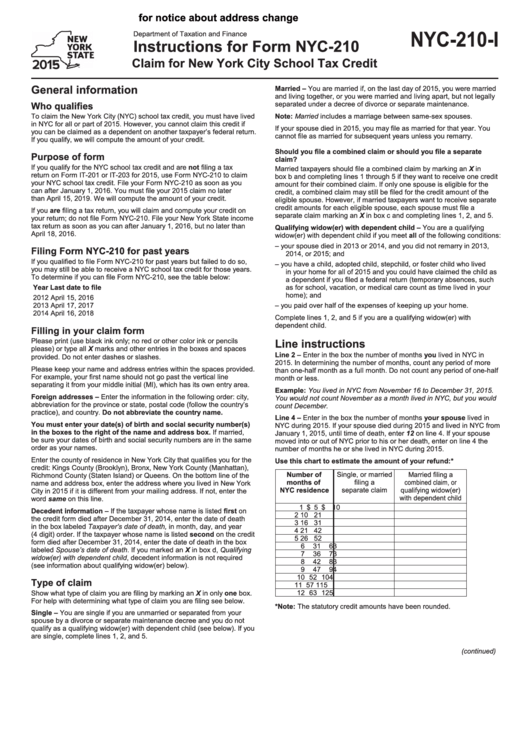

Use this chart to estimate the amount of your refund:*

credit: Kings County (Brooklyn), Bronx, New York County (Manhattan),

Single, or married

Number of

Married filing a

Richmond County (Staten Island) or Queens. On the bottom line of the

filing a

months of

combined claim, or

name and address box, enter the address where you lived in New York

NYC residence

separate claim

qualifying widow(er)

City in 2015 if it is different from your mailing address. If not, enter the

with dependent child

word same on this line.

1

$ 5

$ 10

Decedent information – If the taxpayer whose name is listed first on

2

10

21

the credit form died after December 31, 2014, enter the date of death

3

16

31

in the box labeled Taxpayer’s date of death, in month, day, and year

4

21

42

(4 digit) order. If the taxpayer whose name is listed second on the credit

5

26

52

form died after December 31, 2014, enter the date of death in the box

6

31

63

labeled Spouse’s date of death. If you marked an X in box d, Qualifying

7

36

73

widow(er) with dependent child, decedent information is not required

8

42

83

(see information about qualifying widow(er) below).

9

47

94

10

52

104

Type of claim

11

57

115

12

63

125

Show what type of claim you are filing by marking an X in only one box.

For help with determining what type of claim you are filing see below.

*Note: The statutory credit amounts have been rounded.

Single – You are single if you are unmarried or separated from your

spouse by a divorce or separate maintenance decree and you do not

qualify as a qualifying widow(er) with dependent child (see below). If you

are single, complete lines 1, 2, and 5.

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3