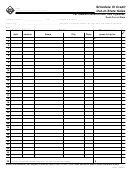

MARYLAND OTHER TOBACCO

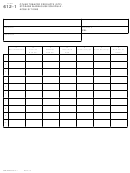

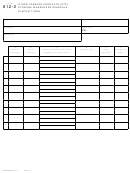

fORM

Page 2

610C

PRODUCTS (OTP) TAX RETURN -

SCHEDULE C - OTP TAX CREDiT -

2013

OUT Of STATE SALES

Who must file this Form 610C?

4c, 5c

Multiply the total net invoice amount of

untaxed OTP by the applicable tax rate.

OTP RETAILER - An OTP retailer who reports

Enter this amount on Line 6.

purchases of “pipe tobacco” or “premium cigars”

on Line 1a or 2a of its Maryland OTP tax return,

6

Add Lines 4c and 5c.

Form 610 and for which an OTP tax credit is claimed,

because the pipe tobacco or premium cigars were

7

Add lines 3 and 6. Enter this amount on

sold out-of-state.

line 7 of the OTP tax return, Form 610.

For more information:

OTP TOBACCONIST - An OTP tobacconist who

reports purchases of OTP on Line 4a or 5a of its

Comptroller of Maryland

Maryland untaxed OTP tax return, Form 610 and for

Revenue Administration Division

which an OTP tax credit is claimed, because the OTP

P O Box 2999

was sold out-of-state.

Annapolis, MD 21404-2999

This schedule must be completed and submitted

with your Maryland OTP tax return, Form 610, for

Telephone: 410-260-7980, 800-638-2937

any report period in which an OTP tax credit is

Fax: 410-974-3608

claimed Enter your legal name, report period, type

of license, and license number on the lines provided.

Instructions for completion:

Line

1a, 2a

OTP RETAILER - Provide the total net invoice

amount for all untaxed “pipe tobacco” and

“premium cigars” reported on Lines 1a and

2a of the OTP tax return (Form 610) that

was sold out-of-state during the report

quarter

4a, 5a

OTP TOBACCONIST - Provide the net

total invoice amount for all untaxed OTP

reported on Lines 4a and 5a of the OTP

tax return (Form 610) that was sold out-of-

state during the report quarter

1b, 2b, The applicable OTP tax rate.

4b, 5b

1c, 2c

Multiply the total net invoice amount of

untaxed “pipe tobacco” and “premium

cigar” by the applicable tax rate. Enter this

amount on Line 3.

3

Add Lines 1c and 3c.

COM/RAD-610-3

02/13

1

1 2

2