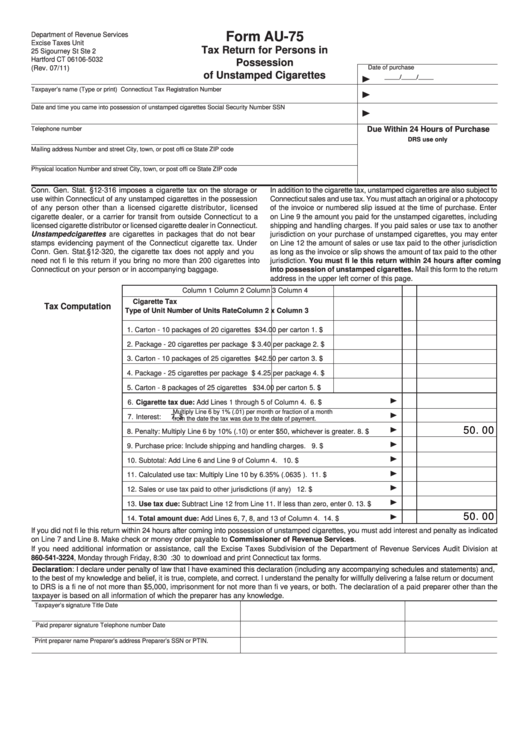

Form AU-75

Department of Revenue Services

Excise Taxes Unit

Tax Return for Persons in

25 Sigourney St Ste 2

Hartford CT 06106-5032

Possession

(Rev. 07/11)

Date of purchase

of Unstamped Cigarettes

_____/_____/_____

Taxpayer’s name (Type or print)

Connecticut Tax Registration Number

Date and time you came into possession of unstamped cigarettes

Social Security Number SSN

Telephone number

Due Within 24 Hours of Purchase

DRS use only

Mailing address

Number and street

City, town, or post offi ce

State

ZIP code

Physical location

Number and street

City, town, or post offi ce

State

ZIP code

Conn. Gen. Stat. §12-316 imposes a cigarette tax on the storage or

In addition to the cigarette tax, unstamped cigarettes are also subject to

use within Connecticut of any unstamped cigarettes in the possession

Connecticut sales and use tax. You must attach an original or a photocopy

of any person other than a licensed cigarette distributor, licensed

of the invoice or numbered slip issued at the time of purchase. Enter

cigarette dealer, or a carrier for transit from outside Connecticut to a

on Line 9 the amount you paid for the unstamped cigarettes, including

licensed cigarette distributor or licensed cigarette dealer in Connecticut.

shipping and handling charges. If you paid sales or use tax to another

Unstamped cigarettes are cigarettes in packages that do not bear

jurisdiction on your purchase of unstamped cigarettes, you may enter

stamps evidencing payment of the Connecticut cigarette tax. Under

on Line 12 the amount of sales or use tax paid to the other jurisdiction

Conn. Gen. Stat. §12-320, the cigarette tax does not apply and you

as long as the invoice or slip shows the amount of tax paid to the other

need not fi le this return if you bring no more than 200 cigarettes into

jurisdiction. You must fi le this return within 24 hours after coming

Connecticut on your person or in accompanying baggage.

into possession of unstamped cigarettes. Mail this form to the return

address in the upper left corner of this page.

Column 1

Column 2

Column 3

Column 4

Cigarette Tax

Tax Computation

Type of Unit

Number of Units

Rate

Column 2 x Column 3

1.

Carton - 10 packages of 20 cigarettes

$34.00 per carton

1. $

2.

Package - 20 cigarettes per package

$ 3.40 per package

2. $

3.

Carton - 10 packages of 25 cigarettes

$42.50 per carton

3. $

4.

Package - 25 cigarettes per package

$ 4.25 per package

4. $

5.

Carton - 8 packages of 25 cigarettes

$34.00 per carton

5. $

6.

Cigarette tax due: Add Lines 1 through 5 of Column 4.

6. $

Multiply Line 6 by 1% (.01) per month or fraction of a month

7.

Interest:

7. $

from the date the tax was due to the date of payment.

50.00

8.

Penalty: Multiply Line 6 by 10% (.10) or enter $50, whichever is greater.

8. $

9.

Purchase price: Include shipping and handling charges.

9. $

10. Subtotal: Add Line 6 and Line 9 of Column 4.

10. $

11. Calculated use tax: Multiply Line 10 by 6.35% (.0635 ).

11. $

12. Sales or use tax paid to other jurisdictions (if any)

12. $

13. Use tax due: Subtract Line 12 from Line 11. If less than zero, enter 0.

13. $

50.00

14. Total amount due: Add Lines 6, 7, 8, and 13 of Column 4.

14. $

If you did not fi le this return within 24 hours after coming into possession of unstamped cigarettes, you must add interest and penalty as indicated

on Line 7 and Line 8. Make check or money order payable to Commissioner of Revenue Services.

If you need additional information or assistance, call the Excise Taxes Subdivision of the Department of Revenue Services Audit Division at

860-541-3224, Monday through Friday, 8:30 a.m. to 4:30 p.m. Visit the DRS website at to download and print Connecticut tax forms.

Declaration: I declare under penalty of law that I have examined this declaration (including any accompanying schedules and statements) and,

to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document

to DRS is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the

taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Paid preparer signature

Telephone number

Date

Print preparer name

Preparer’s address

Preparer’s SSN or PTIN.

1

1