MARylAnD OTHeR TOBAccO PRODUcTs

fORM

Page 2

609

(OTP) WHOlesAleR TAX ReTURn

insTRUcTiOns

2013

This return and the OTP tax due, as required by

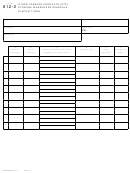

C

1a, 2a, 3a-3e

Tax-General Article, Section 12-202(a)(2), shall

Combined by OTP product type, enter the

be properly filed and received by the Revenue

Total Wholesale Price of all sales in Maryland

Administration Division no later than the 21st day

during the report month. For purposes of this

of the month following the month in which the

return, “Wholesale Price” means the price for

wholesaler has sold OTP to a Maryland OTP retailer

which an OTP wholesaler buys OTP from an

or tobacconist. If the due date is a weekend or State

OTP manufacturer. The sum of Column C is

Holiday, the deadline is automatically extended to

the total amount of invoices (wholesale prices)

the next business day. A return must be filed even

after subtraction of all OTP credits from the

for a month in which there was no activity. For

OTP manufacturer, but without any reduction

purposes of this return, an OTP “wholesaler” is a

of discounts trade allowances, rebates, or the

person, whether located in or out of the State, who

federal tobacco floor tax.

holds for sale or sells OTP to a licensed OTP retailer

3f

or tobacconist in Maryland.

Enter the total of Lines 3a through 3e.

Each

wholesaler

shall

maintain

supporting

documentation

as

required

under

Business

1c, 2c, 3h

Regulation Article, Section 16.5-214.

Multiply total wholesale price by the applicable tax

“Premium cigars” means cigars that have hand-

rate.

rolled wrappers made from whole tobacco leaves

4

where the filler, binder, and wrapper are made of

Add lines 1c, 2c, and 3h for total tax due.

all tobacco, and may include adhesives or other

materials used to maintain size, texture, or flavor.

Make

checks

payable

to

“Comptroller

of

Maryland”. Send payment to:

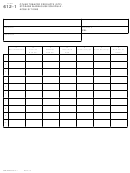

Column Line

Comptroller of Maryland

B

1a, 2a, 3a-3e

Revenue Administration Division

Enter the number of sales transactions for each

P.O. Box 2999

product type of OTP sold in Maryland during the

Annapolis, MD 21404-2999

report month. Schedule A (Form 609A) must be

The completed OTP Wholesaler Tax Return must be

completed for all Roll-Your-Own (RYO) tobacco

signed by an owner, partner, officer of the corporation,

sales during the report month.

or an agent who has signing authority binding the

Note: The number of sales reported in Column

owner, partner, or officer of the corporation.

B should correspond with the number of sales

For more information:

reported by product type from your invoices. For

example, if you report 20 sales transactions of

cigars in Column B, these 20 sales transactions

Telephone: 410-260-7980, 1-800-638-2937

must be reported from your invoices. If you

Fax: 410-974-3608

report 25 sales transactions of RYO tobacco in

Column B, these 25 sales transactions must be

reported from your invoices. In addition, for

RYO tobacco, these 25 sales transactions must

be reported on Schedule A.

COM/RAD-609

Revised 02/13

1

1 2

2