2012

Page

3 of 4

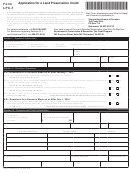

Schedule FC‑A

Name(s) shown on Schedule FC‑A

Social security number or FEIN

Note: You must include this page as part of Schedule FC‑A if your claim is based on more than one farm.

Enclose additional copies of this page if needed.

QUALIFYING ACRES SCHEDULE

OF

County

Town

Village

City

of

Enter the primary location of the farm

Step 1

For each tax parcel that 1) is part of the farm and 2) has qualifying acres, as described below, enter:

Step 2

Column (A) tax parcel number

Column (B) number of qualifying acres in the parcel subject to an original or modified farmland preservation

agreement entered into after July 1, 2009, and located in a farmland preservation zoning district

Column (C) number of qualifying acres in the parcel located in a farmland preservation zoning district, but not

subject to an original or modified farmland preservation agreement entered into after July 1, 2009

Column (D) number of qualifying acres in the parcel subject to an original or modified farmland preservation

agreement entered into after July 1, 2009, but not located in a farmland preservation zoning district

Number of Acres from Each Category Above

Tax Parcel Number

(A)

(B)

(C)

(D)

Note: If the farm consists of more than 10 parcels, enclose page 4

Using the acres listed in Step 2, compute the qualifying acres on which your claim is based

Step 3

(B)

(C)

(D)

1 Enter the total acres from Columns (B), (C), and (D) above

and, if applicable, page 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Enter in all three columns your ownership percentage of the farm.

Enter as a decimal carried to four places (If 100%, enter “1.0000”) . .

.

.

.

3 Multiply line 1 by line 2, and round result to the nearest acre.

Fill in here and on line 4 of page 2 . . . . . . . . . . . . . . . . . . . . . . . . . .

I‑025bi

Wisconsin Department of Revenue

1

1 2

2 3

3 4

4