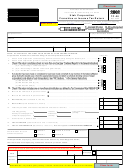

Supplemental Information to be Supplied by All Corporations

TC-20_2 2012

20202

/

/

1. What is the date of incorporation (mm/dd/yyyy) _ __________ and in what state or country? __ _ _ _ _ _ _ _ _ _ _ _

2. If this corporation is dissolved or withdrawn, see Dissolution or Withdrawal in the General Instructions.

3. ___ Yes

___ No

Did this corporation at any time during its tax year own more than 50 percent of the

voting stock of another corporation or corporations? If yes, provide the following for each

corporation so owned: (attach additional pages if necessary):

Name of corporation _ __ _ __ __ _ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _

Address __ __ __ _ __ _ __ __ _ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _

City, state, ZIP Code_ __ _ __ _ __ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _

/

/

Percentage of stock owned _ _ __ __ __ ___ %

Date stock acquired (mm/dd/yyyy) _ _ _ __ _ _ _ _ _ _ _ _ _ _ _

4. ___ Yes

___ No

Is more than 50 percent of the voting stock of this corporation owned by another corporation?

If yes, provide the following information about the corporation:

Name of corporation _ __ _ __ __ _ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _

Address __ __ __ _ __ _ __ __ _ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _

City, state, ZIP Code_ __ _ __ _ __ __ __________ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _

Percentage of stock held _ __ __ _ __ __ __ %

5. ___ Yes

___ No

Did this corporation or its subsidiary(ies) have a change in control or ownership,

or acquire control or ownership of any other legal entity this year?

6. Where are the corporate books and records maintained?

__ __ __ __ _ __ __ _ __ _ __ __ _ ____________ _ _ _ _ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _

7. What is the state or country of commercial domicile? _________ _ _ _ _ _ _ __ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _

/

/

8. What is the last year for which a federal examination has been completed? _ __ _ _ _ _ _ _ __ _ _ _

mm/dd/yyyy

Under separate cover, send a summary and supporting schedules for all federal adjustments and the federal tax

liability for each year for which federal audit adjustments have not been reported to the Tax Commission and indicate

date of final determination. Forward information to:

Auditing Division, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT 84134-2000.

9. For what years are federal examinations now in progress, and/or final determination of past examinations still pending?

/

/

/

/

/

/

/

/

_ ___ _ __ _ __ __ _ _

__ _ __ __ _ ______

_ _ _ _ __ _ _ _ _ _ _ __

_ _ _ __ _ _ _ _ _ _ _ _ _

mm/dd/yyyy

mm/dd/yyyy

mm/dd/yyyy

mm/dd/yyyy

10. For what years have extensions for proposing additional assessments of federal tax been agreed to with the Internal

Revenue Service?

/

/

/

/

/

/

/

/

_ ___ _ __ _ __ __ _ _

__ _ __ __ _ ______

_ _ _ _ __ _ _ _ _ _ _ __

_ _ _ __ _ _ _ _ _ _ _ _ _

mm/dd/yyyy

mm/dd/yyyy

mm/dd/yyyy

mm/dd/yyyy

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Note: Utah Code §59-7-519 extends the Statute of Limitations for tax assessment if federal audit adjustments are not fully reported.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14