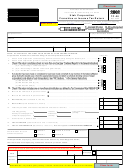

TC-20 H_2 2012

(Use with TC-20, TC-20S & TC-65)

20262

TC-20, Schedule H — continued

Page 2

Part 2: Non-Utah Nonbusiness Income (nonbusiness income allocated outside Utah)

Beginning Value of

Ending Value of

Acquisition Date

Investment Used

Investment Used

Type of Non-Utah

of Non-Utah Non-

to Produce Non-Utah

to Produce Non-Utah

Nonbusiness Income

business Asset(s)

Nonbusiness Income

Nonbusiness Income

Non-Utah Nonbusiness Income

(Column A)

(Column B)

(Column C)

(Column D)

(Column E)

/

/

15a. ___ _ _ _ __ _ __ __ __ __ _ ____ ____ .00 ___ _____ _ .00

_ _____ _____ _ _ _ _ _ _ .00

/

/

15b. ___ _ _ _ __ _ __ __ __ __ _ ____ ____ .00 ___ _____ _ .00

_ _____ _____ _ _ _ _ _ _ .00

/

/

15c. ___ _ _ _ __ _ __ __ __ __ _ ____ ____ .00 ___ _____ _ .00

_ _____ _____ _ _ _ _ _ _ .00

/

/

15d. ___ _ _ _ __ _ __ __ __ __ _ ____ ____ .00 ___ _____ _ .00

_ _____ _____ _ _ _ _ _ _ .00

/

/

15e. ___ _ _ _ __ _ __ __ __ __ _ ____ ____ .00 ___ _____ _ .00

_ _____ _____ _ _ _ _ _ _ .00

16. Totals of columns C and D.................

_ ________ .00 _____ ____ .00

17. Total non-Utah nonbusiness income – add column E for lines 15a through 15e ................

_ _____ _____ _ _ _ _ _ _ .00

18a. Description of direct expenses

Amount of

related to line 15a (above): __ ___ ____ ___________

direct expense:

____________________________ .00

18b. Description of direct expenses

Amount of

related to line 15b (above): __ ___ ____ ___________

direct expense:

____ _____ ___ _ _ _ _ _ .00

18c. Description of direct expenses

Amount of

related to line 15c (above): __ ___ ____ ___________

direct expense:

____________________________ .00

18d. Description of direct expenses

Amount of

related to line 15d (above): __ ___ ____ ___________

direct expense:

____________________________ .00

18e. Description of direct expenses

Amount of

related to line 15e (above): __ ___ ____ ___________

direct expense:

____________________________ .00

19. Total direct related expenses – add lines 18a through 18e ................................................

__ _____ ____ _ _ _ _ _ _ .00

20. Non-Utah nonbusiness income net of direct related expenses – subtract line 19 from line 17

____ _____ ___ _ _ _ _ _ .00

Total Assets Used

Indirect Related Expenses

to Produce Non-Utah

for Non-Utah Nonbusiness Income

Nonbusiness Income

Total Assets

(Column A)

(Column B)

21. Beginning-of-year assets (enter in...

__ _______ .00 ___ _____ _ .00

Col. A the amount from line 16, Col. C)

22. End-of-year assets (enter in Col. A..

__ _______ .00 ___ _____ _ .00

the amount from line 16, Col. D)

23. Sum of beginning and ending asset

_ ________ .00 _____ ____ .00

values – add lines 21 and 22

24. Average asset value – line 23 divided by 2 ___ ______

.00 _______ __ .00

25. Non-Utah nonbusiness assets ratio – line 24, Column A, divided by line 24, Column B ....

__ . __ __ __ __

26. Interest expense deducted in computing Utah taxable income (see instructions) ..............

_ _____ _____ _ _ _ _ _ _ .00

27. Indirect related expenses for non-Utah nonbusiness income – line 25 multiplied by line 26

___ _____ ___ _ _ _ _ _ _ .00

28. Total non-Utah nonbusiness income net of expenses – subtract line 27 from line 20 ........

_ _____ _____ _ _ _ _ _ _ .00

Enter on: TC-20, Schedule A, line 7;

TC-20S, Schedule A, line 8; or

TC-65, Schedule A, line 11

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14