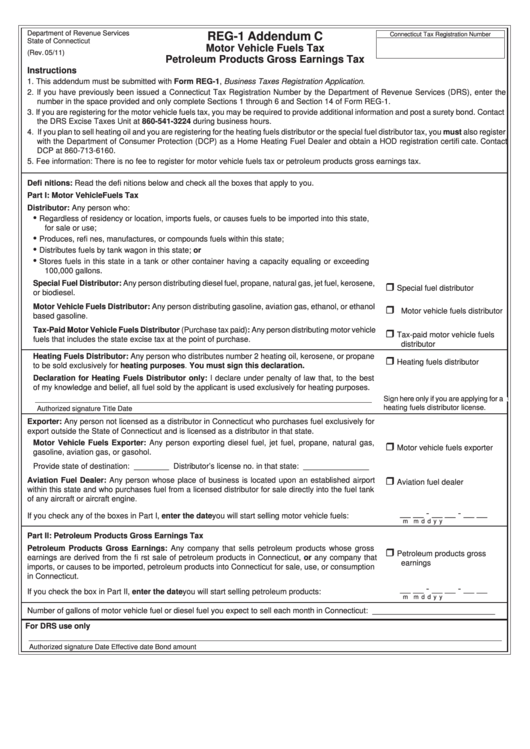

Form Reg-1 Addendum C - Motor Vehicle Fuels Tax - Petroleum Products Gross Earnings Tax

ADVERTISEMENT

Department of Revenue Services

REG-1 Addendum C

Connecticut Tax Registration Number

State of Connecticut

Motor Vehicle Fuels Tax

(Rev. 05/11

05/11)

Petroleum Products Gross Earnings Tax

Instructions

1. This addendum must be submitted with Form REG-1, Business Taxes Registration Application.

2. If you have previously been issued a Connecticut Tax Registration Number by the Department of Revenue Services (DRS), enter the

number in the space provided and only complete Sections 1 through 6 and Section 14 of Form REG-1.

3. If you are registering for the motor vehicle fuels tax, you may be required to provide additional information and post a surety bond. Contact

the DRS Excise Taxes Unit at 860-541-3224 during business hours.

4. If you plan to sell heating oil and you are registering for the heating fuels distributor or the special fuel distributor tax, you must also register

with the Department of Consumer Protection (DCP) as a Home Heating Fuel Dealer and obtain a HOD registration certifi cate. Contact

DCP at 860-713-6160.

5. Fee information: There is no fee to register for motor vehicle fuels tax or petroleum products gross earnings tax.

Defi nitions: Read the defi nitions below and check all the boxes that apply to you.

Part I: Motor Vehicle Fuels Tax

Distributor: Any person who:

•

Regardless of residency or location, imports fuels, or causes fuels to be imported into this state,

for sale or use;

•

Produces, refi nes, manufactures, or compounds fuels within this state;

•

Distributes fuels by tank wagon in this state; or

•

Stores fuels in this state in a tank or other container having a capacity equaling or exceeding

100,000 gallons.

Special Fuel Distributor: Any person distributing diesel fuel, propane, natural gas, jet fuel, kerosene,

Special fuel distributor

or biodiesel. ........................................................................................................................................

Motor Vehicle Fuels Distributor: Any person distributing gasoline, aviation gas, ethanol, or ethanol

Motor vehicle fuels distributor

based gasoline. ..................................................................................................................................

Tax-Paid Motor Vehicle Fuels Distributor (Purchase tax paid): Any person distributing motor vehicle

Tax-paid motor vehicle fuels

fuels that includes the state excise tax at the point of purchase. .......................................................

distributor

Heating Fuels Distributor: Any person who distributes number 2 heating oil, kerosene, or propane

Heating fuels distributor

to be sold exclusively for heating purposes. You must sign this declaration. ..............................

Declaration for Heating Fuels Distributor only: I declare under penalty of law that, to the best

of my knowledge and belief, all fuel sold by the applicant is used exclusively for heating purposes.

Sign here only if you are applying for a

Sign here only if you are applying for a

heating fuels distributor license.

heating fuels distributor license.

Authorized signature

Title

Date

Exporter: Any person not licensed as a distributor in Connecticut who purchases fuel exclusively for

export outside the State of Connecticut and is licensed as a distributor in that state.

Motor Vehicle Fuels Exporter: Any person exporting diesel fuel, jet fuel, propane, natural gas,

Motor vehicle fuels exporter

gasoline, aviation gas, or gasohol. ....................................................................................................

Provide state of destination: ________ Distributor’s license no. in that state: _______________

Aviation Fuel Dealer: Any person whose place of business is located upon an established airport

Aviation fuel dealer

within this state and who purchases fuel from a licensed distributor for sale directly into the fuel tank

of any aircraft or aircraft engine. ............................................................................................................

__ __ - __ __ - __ __

If you check any of the boxes in Part I, enter the date you will start selling motor vehicle fuels: ........

m

m

d

d

y

y

Part II: Petroleum Products Gross Earnings Tax

Petroleum Products Gross Earnings: Any company that sells petroleum products whose gross

Petroleum products gross

earnings are derived from the fi rst sale of petroleum products in Connecticut, or any company that

earnings

imports, or causes to be imported, petroleum products into Connecticut for sale, use, or consumption

in Connecticut. ......................................................................................................................................

__ __ - __ __ - __ __

If you check the box in Part II, enter the date you will start selling petroleum products: ......................

m

m

d

d

y

y

Number of gallons of motor vehicle fuel or diesel fuel you expect to sell each month in Connecticut: ____________________________

For DRS use only

Authorized signature

Date

Effective date

Bond amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1