Form Reg-1 Addendum D - Alcoholic Beverages Tax

ADVERTISEMENT

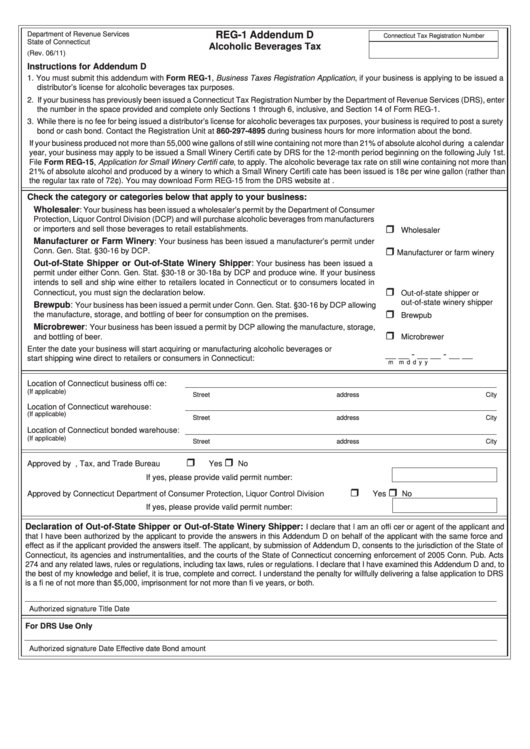

REG-1 Addendum D

Department of Revenue Services

Connecticut Tax Registration Number

State of Connecticut

Alcoholic Beverages Tax

(Rev. 06/11)

Instructions for Addendum D

1. You must submit this addendum with Form REG-1, Business Taxes Registration Application, if your business is applying to be issued a

distributor’s license for alcoholic beverages tax purposes.

2. If your business has previously been issued a Connecticut Tax Registration Number by the Department of Revenue Services (DRS), enter

the number in the space provided and complete only Sections 1 through 6, inclusive, and Section 14 of Form REG-1.

3. While there is no fee for being issued a distributor’s license for alcoholic beverages tax purposes, your business is required to post a surety

bond or cash bond. Contact the Registration Unit at 860-297-4895 during business hours for more information about the bond.

If your business produced not more than 55,000 wine gallons of still wine containing not more than 21% of absolute alcohol during a calendar

year, your business may apply to be issued a Small Winery Certifi cate by DRS for the 12-month period beginning on the following July 1st.

File Form REG-15, Application for Small Winery Certifi cate, to apply. The alcoholic beverage tax rate on still wine containing not more than

21% of absolute alcohol and produced by a winery to which a Small Winery Certifi cate has been issued is 18¢ per wine gallon (rather than

the regular tax rate of 72¢). You may download Form REG-15 from the DRS website at

Check the category or categories below that apply to your business:

Wholesaler

: Your business has been issued a wholesaler’s permit by the Department of Consumer

Protection, Liquor Control Division (DCP) and will purchase alcoholic beverages from manufacturers

or importers and sell those beverages to retail establishments. .........................................................

Wholesaler

Manufacturer or Farm Winery

: Your business has been issued a manufacturer’s permit under

Conn. Gen. Stat. §30-16 by DCP. .......................................................................................................

Manufacturer or farm winery

Out-of-State Shipper or Out-of-State Winery Shipper:

Your business has been issued a

permit under either Conn. Gen. Stat. §30-18 or 30-18a by DCP and produce wine. If your business

intends to sell and ship wine either to retailers located in Connecticut or to consumers located in

Connecticut, you must sign the declaration below. .............................................................................

Out-of-state shipper or

out-of-state winery shipper

Brewpub:

Your business has been issued a permit under Conn. Gen. Stat. §30-16 by DCP allowing

the manufacture, storage, and bottling of beer for consumption on the premises. .............................

Brewpub

Microbrewer:

Your business has been issued a permit by DCP allowing the manufacture, storage,

and bottling of beer. ............................................................................................................................

Microbrewer

Enter the date your business will start acquiring or manufacturing alcoholic beverages or

__ __ - __ __ - __ __

start shipping wine direct to retailers or consumers in Connecticut:

m

m

d

d

y

y

Location of Connecticut business offi ce:

(If applicable)

Street address

City

Location of Connecticut warehouse:

(If applicable)

Street address

City

Location of Connecticut bonded warehouse:

(If applicable)

Street address

City

Approved by U.S. Treasury, Tax, and Trade Bureau .............................................................................

Yes

No

If yes, please provide valid permit number: ....................................

Approved by Connecticut Department of Consumer Protection, Liquor Control Division .....................

Yes

No

If yes, please provide valid permit number: ....................................

Declaration of Out-of-State Shipper or Out-of-State Winery Shipper:

I declare that I am an offi cer or agent of the applicant and

that I have been authorized by the applicant to provide the answers in this Addendum D on behalf of the applicant with the same force and

effect as if the applicant provided the answers itself. The applicant, by submission of Addendum D, consents to the jurisdiction of the State of

Connecticut, its agencies and instrumentalities, and the courts of the State of Connecticut concerning enforcement of 2005 Conn. Pub. Acts

274 and any related laws, rules or regulations, including tax laws, rules or regulations. I declare that I have examined this Addendum D and, to

the best of my knowledge and belief, it is true, complete and correct. I understand the penalty for willfully delivering a false application to DRS

is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both.

Authorized signature

Title

Date

For DRS Use Only

Authorized signature

Date

Effective date

Bond amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1