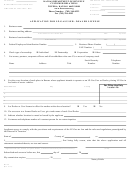

INSTRUCTIONS

July 1, 2003 – June 30, 2020

Complete all the information on the reverse side for each motor vehicle. Indicate weight class by referring to the

schedule below. The amount of tax for each motor vehicle is based upon the gross weight of the vehicle and the

number of miles it was operated on the public highways of Kansas during the previous year. On vehicles placed in

operation after the first month of the calendar year the tax will be prorated on the basis of the gross weight and the

mileage for the months operated in the calendar year.

TAX SCHEDULE PER VEHICLE

Less than

5,000

10,001

15,001

20,000

30,000

40,000

50,000

60,000

5,000

to 10,000

to 15,000

to 19,999

to 29,999

to 39,999

to 49,999

to 59,999

miles

WEIGHT CLASS

miles

miles

miles

miles

miles

miles

miles

miles

and over

Class A: 3,000 pounds or less

$

46.00

$

92.00

$ 138.00

$ 184.00

$ 276.00

$ 368.00

$ 460.00

$ 552.00

$ 644.00

Class B: more than 3,000

$

78.00

$ 156.00

$ 234.00

$ 312.00

$ 468.00

$ 624.00

$ 780.00

$ 936.00

$ 1092.00

pounds and not more than

4,500 pounds

Class C: more than 4,500

$

95.00

$ 189.00

$ 285.00

$ 380.00

$ 570.00

$ 760.00

$ 950.00

$ 1140.00

$ 1330.00

pounds and not more than

12,000 pounds

Class D: more than 12,000

$

129.00

$ 258.00

$ 387.00

$ 516.00

$ 774.00

$ 1032.00

$ 1290.00

$ 1548.00

$ 1806.00

pounds and not more than

16,000 pounds

Class E: more than 16,000

$ 165.00

$ 330.00

$ 495.00

$ 660.00

$ 990.00

$ 1320.00

$ 1650.00

$ 1980.00

$ 2310.00

pounds and not more than

24,000 pounds

Class F: more than 24,000

$ 230.00

$ 460.00

$ 690.00

$ 920.00

$ 1380.00

$ 1840.00

$ 2300.00

$ 2760.00

$ 3220.00

pounds and not more than

36,000 pounds

Class G: more than 36,000

$ 285.00

$ 570.00

$ 855.00

$ 1140.00

$ 1710.00

$ 2280.00

$ 2850.00

$ 3420.00

$ 3990.00

pounds and not more than

48,000 pounds

Class H: more than 48,000

$ 384.00

$ 768.00

$ 1152.00

$ 1536.00

$ 2304.00

$ 3072.00

$ 3840.00

$ 4608.00

$ 5376.00

pounds

Class I: Transit carrier

$ 1808.00

vehicles operated by transit

companies

Class J: Motor vehicles

$ 939.00

designed for carrying fewer

than 10 passengers and used

for the transportation of

persons for compensation

Please direct any inquiries regarding this application to the address below:

Motor Fuel Tax Section

Kansas Department Of Revenue

Motor Fuel Tax

915 SW Harrison St.

Topeka, Kansas 66625-0001

Phone Number: (785) 368-8222

Hearing Impaired TTY: 1-785-296-6117

Fax: (785) 296-4993

1

1 2

2