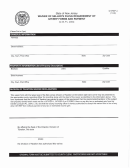

Waiver of Seller’s Filing Requirement Instructions

This form is only to be completed by individuals, estates, trusts or any other entity recording a deed not

subject to the Gross Income Tax estimated payment requirements under C.55, P.L. 2004 and not covered

by one of the other GIT/REP forms.

Name(s):

Name of owner(s).

Address:

Owner(s) primary residence or place of business.

Property Information:

Information as listed on deed being recorded.

All information requested on this form must be completed. Failure to complete the form in its entirety will

result in the deed not being recorded.

This form, along with documentation supporting the request for exemption, must be completed and

submitted to the Division of Taxation, Regulatory Services Branch, PO Box 269, Trenton, New Jersey,

08695 for approval prior to the deed being presented to the County Clerk for recording.

Documentation

supporting the request should include:

1. Detailed reasons why the exemption is being requested.

2. Copy of the RESPA/HUD-1 form or other documentation, other than the deed, showing the date the

transaction closed or deed conveyed.

3. Copy of deed or deeds to be recorded or rerecorded.

The Division of Taxation may request additional documentation or information as it deems necessary to

make a determination.

The Division of Taxation will either approve the request by affixing the raised seal of the Director, Division of

Taxation to the form or send a rejection notice.

The owner or owner's attorney must submit the original Waiver of Seller’s Filing Requirement of GIT/REP

Forms and Payment to the County Clerk at the time of recording the deed. Failure to submit this form or a

Nonresident Seller’s Tax Declaration (GIT/REP-1) or a Nonresident Seller’s Tax Prepayment Receipt

(GIT/REP-2) or a Seller’s Residency Certification (GIT/REP-3) will result in the deed not being recorded.

The county clerk will attach this form to the deed when recording the deed.

1

1 2

2