Form Rpd-41338 - New Mexico Personal Income Tax Taxpayer Waiver For Preparers Electronic Filing Requirement - 2014

ADVERTISEMENT

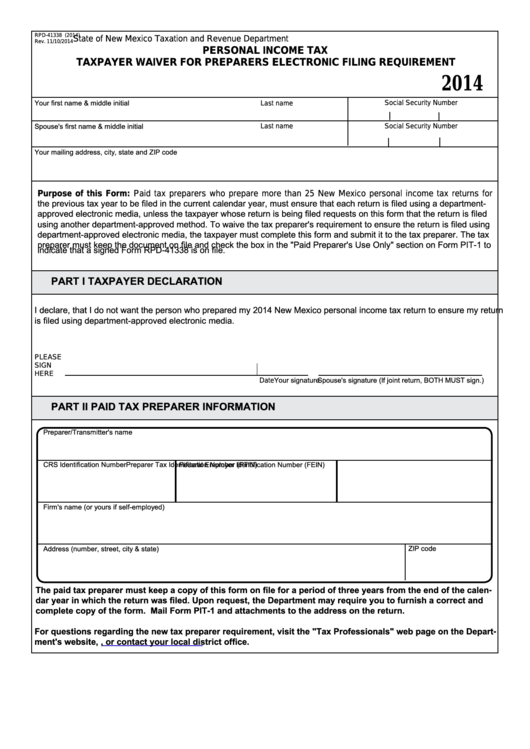

State of New Mexico Taxation and Revenue Department

RPD-41338 (2014)

Rev. 11/10/2014

PERSONAL INCOME TAX

TAXPAYER WAIVER FOR PREPARERS ELECTRONIC FILING REQUIREMENT

2014

Social Security Number

Your first name & middle initial

Last name

Last name

Social Security Number

Spouse's first name & middle initial

Your mailing address, city, state and ZIP code

Purpose of this Form: Paid tax preparers who prepare more than 25 New Mexico personal income tax returns for

the previous tax year to be filed in the current calendar year, must ensure that each return is filed using a department-

approved electronic media, unless the taxpayer whose return is being filed requests on this form that the return is filed

using another department-approved method. To waive the tax preparer's requirement to ensure the return is filed using

department-approved electronic media, the taxpayer must complete this form and submit it to the tax preparer. The tax

preparer must keep the document on file and check the box in the "Paid Preparer's Use Only" section on Form PIT-1 to

indicate that a signed Form RPD-41338 is on file.

PART I

TAXPAYER DECLARATION

I declare, that I do not want the person who prepared my 2014 New Mexico personal income tax return to ensure my return

is filed using department-approved electronic media.

PLEASE

SIGN

HERE

Your signature

Date

Spouse's signature (If joint return, BOTH MUST sign.)

PART II

PAID TAX PREPARER INFORMATION

Preparer/Transmitter's name

Preparer Tax Identification Number (PTIN)

CRS Identification Number

Federal Employer Identification Number (FEIN)

Firm's name (or yours if self-employed)

ZIP code

Address (number, street, city & state)

The paid tax preparer must keep a copy of this form on file for a period of three years from the end of the calen-

dar year in which the return was filed. Upon request, the Department may require you to furnish a correct and

complete copy of the form. Mail Form PIT-1 and attachments to the address on the return.

For questions regarding the new tax preparer requirement, visit the "Tax Professionals" web page on the Depart-

ment's website, , or contact your local district office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1