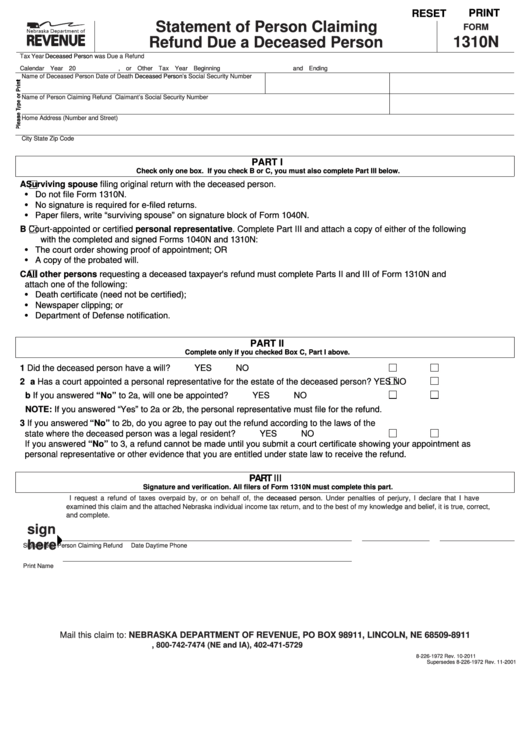

RESET

PRINT

Statement of Person Claiming

FORM

Refund Due a Deceased Person

1310N

Tax Year

Deceased Person

was Due a Refund

Calendar Year 20

, or Other Tax Year Beginning

and Ending

Name of Deceased Person

Date of Death

Deceased Person’s

Social Security Number

Name of Person Claiming Refund

Claimant’s Social Security Number

Home Address (Number and Street)

City

State

Zip Code

PART I

Check only one box. If you check B or C, you must also complete Part III below.

A

Surviving spouse filing original return with the deceased person.

• Do not file Form 1310N.

• No signature is required for e-filed returns.

• Paper filers, write “surviving spouse” on signature block of Form 1040N.

B

Court-appointed or certified personal representative. Complete Part III and attach a copy of either of the following

with the completed and signed Forms 1040N and 1310N:

• The court order showing proof of appointment; OR

• A copy of the probated will.

All other persons requesting a deceased taxpayer's refund must complete Parts II and III of Form 1310N and

C

attach one of the following:

• Death certificate (need not be certified);

• Newspaper clipping; or

• Department of Defense notification.

PART II

Complete only if you checked Box C, Part I above.

1 Did the deceased person have a will? ...................................................................................

YES

NO

2 a Has a court appointed a personal representative for the estate of the deceased person?

YES

NO

b If you answered “No” to 2a, will one be appointed? .........................................................

YES

NO

NOTE: If you answered “Yes” to 2a or 2b, the personal representative must file for the refund.

3 If you answered “No” to 2b, do you agree to pay out the refund according to the laws of the

state where the deceased person was a legal resident? ......................................................

YES

NO

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment as

personal representative or other evidence that you are entitled under state law to receive the refund.

PART III

Signature and verification. All filers of Form 1310N must complete this part.

I request a refund of taxes overpaid by, or on behalf of, the

deceased

person. Under penalties of perjury, I declare that I have

examined this claim and the attached Nebraska individual income tax return, and to the best of my knowledge and belief, it is true, correct,

and complete.

sign

here

Signature of Person Claiming Refund

Date

Daytime Phone

Print Name

Mail this claim to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98911, LINCOLN, NE 68509-8911

, 800-742-7474 (NE and IA), 402-471-5729

8-226-1972 Rev. 10-2011

Supersedes 8-226-1972 Rev. 11-2001

1

1 2

2