Reset Form

Print Form

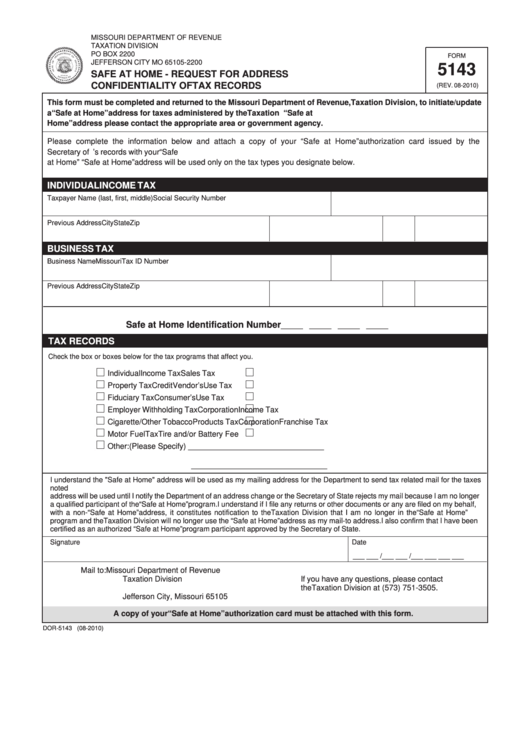

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

PO BOX 2200

FORM

JEFFERSON CITY MO 65105-2200

5143

SAFE AT HOME - REQUEST FOR ADDRESS

CONFIDENTIALITY OF TAX RECORDS

(REV. 08-2010)

This form must be completed and returned to the Missouri Department of Revenue, Taxation Division, to initiate/update

a “Safe at Home” address for taxes administered by the Taxation Division. To change any other addresses to a “Safe at

Home” address please contact the appropriate area or government agency.

Please complete the information below and attach a copy of your “Safe at Home” authorization card issued by the

Secretary of State. This information will be used to update your mail-to address in the Taxation Division’s records with your “Safe

at Home” address. Your “Safe at Home” address will be used only on the tax types you designate below.

INDIVIDUAL INCOME TAX

Taxpayer Name (last, first, middle)

Social Security Number

Previous Address

City

State

Zip

BUSINESS TAX

Business Name

Missouri Tax ID Number

Previous Address

City

State

Zip

Safe at Home Identification Number

_____ _____ _____ _____

TAX RECORDS

Check the box or boxes below for the tax programs that affect you.

Individual Income Tax

Sales Tax

Property Tax Credit

Vendor’s Use Tax

Fiduciary Tax

Consumer’s Use Tax

Employer Withholding Tax

Corporation Income Tax

Cigarette/Other Tobacco Products Tax

Corporation Franchise Tax

Motor Fuel Tax

Tire and/or Battery Fee

Other: (Please Specify) _______________________________

_______________________________

I understand the "Safe at Home" address will be used as my mailing address for the Department to send tax related mail for the taxes

noted above. This address only affects the mailing address of my residence and does not affect any other addresses. This

address will be used until I notify the Department of an address change or the Secretary of State rejects my mail because I am no longer

a qualified participant of the “Safe at Home” program. I understand if I file any returns or other documents or any are filed on my behalf,

with a non-“Safe at Home” address, it constitutes notification to the Taxation Division that I am no longer in the “Safe at Home”

program and the Taxation Division will no longer use the “Safe at Home” address as my mail-to address. I also confirm that I have been

certified as an authorized “Safe at Home” program participant approved by the Secretary of State.

Signature

Date

___ ___ /___ ___ /___ ___ ___ ___

Mail to:

Missouri Department of Revenue

Taxation Division

If you have any questions, please contact

P.O. Box 2200

the Taxation Division at (573) 751-3505.

Jefferson City, Missouri 65105

A copy of your “Safe at Home” authorization card must be attached with this form.

DOR-5143 (08-2010)

1

1