Interest” section in Form 4890, and apply the calculations in the

Return (Form 4917) or the amount paid through Electronic Funds

Transfer. Include all payments made that apply to the tax year

“Overdue Withholding Interest” worksheet separately to each

included in this return. For example, calendar year filers include

portion of the late period. Combine these interest subtotals and

carry the total to line 18.

money paid with the above listed returns for the period of January

1, 2012, through December 31, 2012.

Line 20: If line 15 is greater than Line 14, subtract Line 14 from

If the flow-through entity filing this return is an intermediate

Line 15 and enter that amount on this line.

member of a source flow-through entity and has been withheld

NOTE: If an overpayment exists on Line 20, that amount must be

on by that source flow-through entity, then also enter on this line

refunded to the flow-through entity. The overpayment may not be

amounts that have been withheld on this flow-through entity by its

carried forward to the flow-through entity’s next tax period and

source flow-through entity. See the FTW General Instructions for

may not be distributed to the members of the flow-through entity.

more information on withholding on intermediate flow-through

entities.

Reminder: The flow-through entity must sign and date returns.

Preparers must provide a Preparer Taxpayer Identification Number

Intermediate Flow-Through Entities: If the flow-through

(PTIN), FEIN or Social Security number (SSN), as well as a

entity completing the Annual Reconciliation is an intermediate

business name, business address and phone number.

member in a tiered structure that has been withheld on by

its source flow-through entity, then the intermediate flow-

PART 3: FlOW-THROuGH WITHHOlDING

FOR C CORPORATIONS

through entity must call the Department at (517) 636-6925

before filing its Annual Reconciliation. This phone call

Line 21A: Enter the name, FEIN, address, and tax year end of

must be made to allow the intermediate flow-through entity

each C Corporation or intermediate flow-through entity that

the flow-through entity has withheld on during the filing period

to properly claim the amounts that have been withheld on its

listed on this return. Also enter on this line the distributive share

behalf and to allow it to properly distribute those amounts to its

members.

of tentative business income allocated to the C Corporation

or intermediate flow-through entity, before allocation and

Line 16: If the amount entered on Line 15 is less than the amount

apportionment, during the filing period listed on this return. The

entered on Line 14, enter the difference on this line. If the amount

total amount of distributive income entered in this column must

on Line 15 is greater than the amount entered on Line 14, leave

equal the amount entered on line 9A.

this line blank and skip to Line 20.

If the flow-through entity is unitary with a CIT taxpayer, enter that

Line 17: Enter the overdue withholding penalty. Use the

CIT taxpayer first in this part.

following “Overdue Withholding Penalty” worksheet. Refer to the

“Computing Penalty and Interest” section in the Flow-Through

Line 21B: Enter on this line the amount withheld and reported to

this C Corporation or intermediate flow-through entity. The total

Withholding Reconciliation Return booklet general instructions to

determine the appropriate penalty percentage.

amount of withholding entered in this column must equal the

amount entered on line 13A.

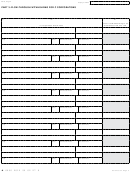

WORKSHEET – OvERDuE WITHHOlDING PENAlTy

PART 4: FlOW-THROuGH WITHHOlDING FOR

A. Withholding due from

NONRESIDENT INDIvIDuAlS

Line 22A: Enter the name of each nonresident individual that was

00

Form 4918, line 16................................

B. Late or insufficient payment

withheld on during the filing period listed on this return.

penalty percentage ...............................

%

Line 22B: Trusts are not required to be withheld on under FTW.

C. Multiply line A by line B .....................

00

However, if a trust was withheld on, enter an “X” on this line for

each trust that was withheld on.

Carry amount from line C to Form 4918, line 17.

Line 22C: Enter the social security number of this nonresident

Line 18: Enter the overdue withholding interest. Use the

individual. If a trust was withheld on, enter the FEIN of the trust.

following “Overdue Withholding Interest” worksheet. Refer to the

“Computing Penalty and Interest” section in the Flow-Through

Line 22D: Enter on this line the distributive share of taxable

income allocated to this nonresident individual, before allocation

Withholding Reconciliation Return booklet general instructions to

and apportionment, during the filing period listed on this return.

determine the appropriate penalty percentage.

The total amount of taxable income entered in this column must

equal the amount entered on line 9B.

WORKSHEET – OvERDuE WITHHOlDING INTEREST

A. Withholding due from

Line 22E: Enter on this line the amount withheld and reported

to this nonresident individual. The total amount of withholding

00

Form 4918, line 16................................

entered on this column must equal the amount entered on line 13B.

B. Applicable daily interest percentage ...

%

C. Number of days return was past due ...

D. Multiply line B by line C ....................

%

E. Multiply line A by line D ....................

00

Carry amount from line E to Form 4918, line 18.

NOTE: If the late period spans more than one interest rate

period, divide the late period into the number of days in each of

the interest rate periods identified in the “Computing Penalty and

16

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8