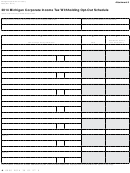

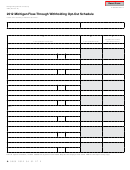

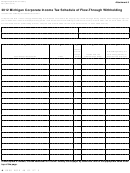

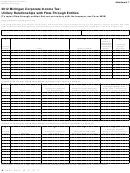

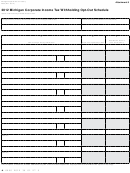

Form 4903 - Michigan Corporate Income Tax Withholding Opt-Out Schedule - 2012 Page 3

ADVERTISEMENT

Instructions for Form 4903

Corporate Income Tax Withholding Opt-Out Schedule

UBGs: If this taxpayer is a UBG and has submitted an

Purpose

exemption certificate to a flow-through entity it is unitary

with, and more than one member of the UBG has an ownership

To report the flow-through entities to which this taxpayer has

submitted an exemption certificate, in order to relieve the flow-

interest in, the flow-through entity, enter the information for

this flow-through entity on the Form 4903 that is completed

through entity of its obligation to withhold on this taxpayer.

by the DM. If the DM has to file more than one copy of Form

4903, only list the flow-through entities that the UBG is unitary

General Instructions

with once.

A C Corporation is able to relieve a flow-through entity of its

Flow-Through Withholding requirements to withhold on that

Column by Column Instructions

C Corporation by filing an exemption certificate with the flow-

Taxpayer information: Enter the name and FEIN of the

through entity. A taxpayer that has submitted an exemption

certificate to a flow-through entity must fill out this form to

taxpayer filing this form as reported on page 1 of CIT Annual

report each flow-through entity to which it has submitted an

Return (Form 4891).

exemption certificate. If more space is needed to report all

UBGs: If this taxpayer is a UBG, enter the name and FEIN of

of the flow-through entities that have received an exemption

the DM for the standard members of this UBG on the first line

certificate from this taxpayer, include additional copies of

as it has been reported on page 1 of Form 4891. Enter the name

Form 4903. Include at the top of each Form 4903 the name

and FEIN of the member of the UBG that is reporting on this

and Federal Employer Identification Number (FEIN) of the

form on the second line as it has been reported on page one of

taxpayer. If this taxpayer is a Unitary Business Group (UBG),

the applicable CIT Data on UBG Members (Form 4897).

enter the FEIN of the Designated Member (DM) at the top of

Column A: Enter the name, address, city, state, and Zip

each additional Form 4903.

code of the flow-through entity that this taxpayer has filed an

This form is required to be included in the taxpayer’s tax return

exemption certificate with.

filing if it has submitted an exemption certificate to a flow-

Column B: Enter the flow-through entity’s FEIN that this

through entity.

taxpayer has filed an exemption certificate with.

Flow-through entities that are unitary with this taxpayer: If

this taxpayer has submitted an exemption certificate to a flow-

Column C: Enter the unapportioned distributive share of the

through entity it is unitary with, enter the information for this

flow-through entity’s income that this taxpayer received as it

has been reported to the taxpayer from the flow-through entity.

flow-through entity first. If more than one copy of Form 4903

is required, only list the flow-through entities that this taxpayer

Include completed Form 4903 as part of the tax return filing.

is unitary with once. For more information on what constitutes

a unitary relationship between a flow-through entity and a

taxpayer, see the instructions for Flow-Through Entities that

are Unitary with the Taxpayer (Form 4900).

83

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3