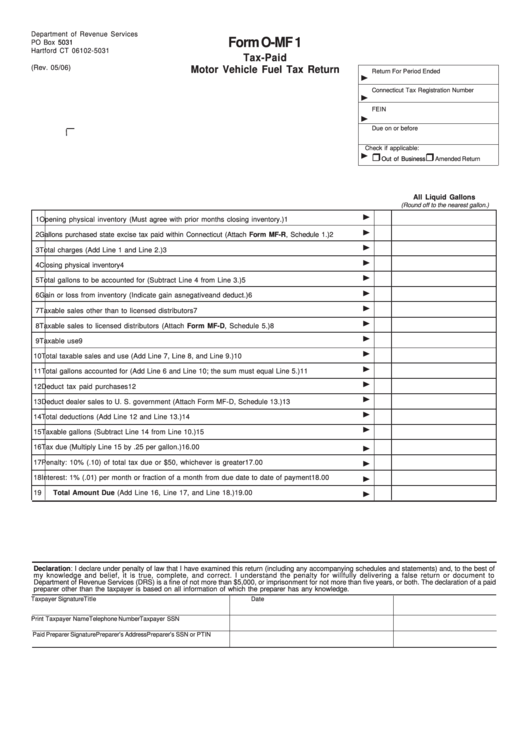

Department of Revenue Services

Form O-MF 1

PO Box

5031

Hartford CT 06102-5031

Tax-Paid

(Rev. 05/06)

Motor Vehicle Fuel Tax Return

Return For Period Ended

Connecticut Tax Registration Number

FEIN

Due on or before

Check if applicable:

Out of Business

Amended Return

All Liquid Gallons

(Round off to the nearest gallon.)

1

Opening physical inventory (Must agree with prior months closing inventory.)

1

2

Gallons purchased state excise tax paid within Connecticut (Attach Form MF-R, Schedule 1.)

2

3

Total charges (Add Line 1 and Line 2.)

3

4

Closing physical inventory

4

5

Total gallons to be accounted for (Subtract Line 4 from Line 3.)

5

6

Gain or loss from inventory (Indicate gain as negative and deduct.)

6

7

Taxable sales other than to licensed distributors

7

8

Taxable sales to licensed distributors (Attach Form MF-D, Schedule 5.)

8

9

Taxable use

9

10

Total taxable sales and use (Add Line 7, Line 8, and Line 9.)

10

11

Total gallons accounted for (Add Line 6 and Line 10; the sum must equal Line 5.)

11

12

Deduct tax paid purchases

12

13

Deduct dealer sales to U. S. government (Attach Form MF-D, Schedule 13.)

13

14

Total deductions (Add Line 12 and Line 13.)

14

15

Taxable gallons (Subtract Line 14 from Line 10.)

15

16

Tax due (Multiply Line 15 by .25 per gallon.)

16

.00

17

Penalty: 10% (.10) of total tax due or $50, whichever is greater

17

.00

18

Interest: 1% (.01) per month or fraction of a month from due date to date of payment

18

.00

19

Total Amount Due (Add Line 16, Line 17, and Line 18.)

19

.00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to

Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid

preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer SSN

Paid Preparer Signature

Preparer’s Address

Preparer’s SSN or PTIN

1

1 2

2