Specific Line Instructions

Additional Information

General Instructions

Part 1 - Reconciliation

If you need additional information or assistance, call the

1.

You must file Form MVF-3 and your monthly

Excise Unit at 860-541-3224, Monday through Friday, 8:30

Line 1

List actual physical inventory on the first day of the

Form O-MF, Motor Vehicle Fuels Tax Return, with the

a.m. to 4:30 p.m.

month being reported.

Commissioner of Revenue Services not later than the

25th day of the month following the calendar month

Visit the DRS website at to download and

Line 2

Enter total receipts from Part 2.

being reported. Example: The Motor Vehicle Fuels

print Connecticut tax forms.

Tax Return for January 1 through January 31 must be

Line 3

Add Lines 1 and 2.

filed on or before February 25. A return must be filed

Line 4

Enter total disbursements from Part 3.

even if no tax is due.

2.

Enter in the spaces provided: Name of terminal operator,

Line 5

Subtract Line 4 from Line 3.

address of terminal operator, customer name, month,

Line 6

List the actual physical inventory on the last day of

terminal operator’s telephone number, and customer

the month for which a report is being filed.

Connecticut Tax Registration Number.

3.

Separate reports are required for each customer

Line 7

Report the inventory variation on this line. Please

who stores or through-puts gasoline at your terminal.

note that losses in excess of .005% of total

Additionally, you must file a separate report for your

accountable-gallons must be documented and may

own activity at the terminal.

be subject to tax under Conn. Gen. Stat. §12-457.

Unaccounted for fuel for which a distributor has

4.

Mail to:

not submitted a satisfactory explanation will

State of Connecticut

be construed to have been sold or used by the

Department of Revenue Services

distributor.

Excise Taxes Unit

25 Sigourney St Ste 2

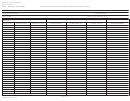

Part 2 - Receipts

Hartford CT 06106-5032

List all receipts of gasoline at the terminal by date including

all book transfers.

Additional receipts must be listed on Page 2 with totals

brought forward to Page 1.

If the product was transported by vessel, list the barge or

ship name.

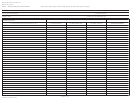

Part 3 - Disbursements

List all disbursements of gasoline from the terminal.

Additional disbursements must be listed on Page 3 with

totals brought forward to Page 1.

If the product was transported by vessel, list the barge or

ship name.

Page 4 of 4

Form MVF-3 Back (Rev. 10/10)

1

1 2

2 3

3 4

4