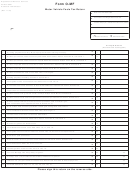

Form Pet 350 - Distributor Monthly Fuel Tax Return Page 4

ADVERTISEMENT

Disbursements Schedule - Distributor Fuel Tax Return (Attach to PET 350)

Company Name:

FEIN:

Account Number:

Month of (MM-YY):

Tennessee Department of Revenue

Product Type (Circle One)

SCHEDULE TYPE

_________

65 GASOLINE

5. GALLONS SOLD TAX COLLECTED

122 BLENDING COMPONENTS (TRANSMIX)

5F. DYED DIESEL GALLONS SOLD FOR TAXABLE PURPOSES

123 ALCOHOL

5H. GALLONS SOLD AS EXPORT FROM IN-STATE TERMINALS (TN TAX COLLECTED)

124 GASOHOL

6D. GALLONS SOLD EXEMPT TO BONDED IMPORTERS

125 AVIATION GASOLINE

6H. GALLONS SOLD OR EXCHANGED WITH QUALIFIED REFINER

130 JET FUEL

6J. GALLONS DELIVERED TAX-FREE TO TN REFINERY

142 KEROSENE

7A. GALLONS EXPORTED - DESTINATION STATE TAX PAID (TN REFINERY INCLUDED)

160 UNDYED DIESEL

8. GALLONS SOLD TO U.S. GOV'T TAX-EXEMPT

226 DIESEL (HIGH SULFUR DYED)

9. GALLONS SOLD TO STATE & LOCAL GOV'T

227 DIESEL (LOW SULFUR DYED)

10A. GALLONS SOLD TO OTHER TAX-EXEMPT ENTITIES

____ OTHER (SEE ITA PRODUCT CODE LIST)

10E. GALLONS SOLD TO CUSTOMERS REPRESENTING UNCOLLECTIBLE FUEL TAXES

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

NAME

CARRIER

POINT OF

TERMINAL

SOLD

PURCHASER

DATE

DOCUMENT

NET

GROSS

BILLED

CARRIER

FEIN

MODE

ORIGIN

DESTINATION

CODE

TO

FEIN

SHIPPED

NUMBER

GALLONS

GALLONS

GALLONS

PAGE __________ OF __________

TOTAL

RV-F1400701

INTERNET 4-03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10