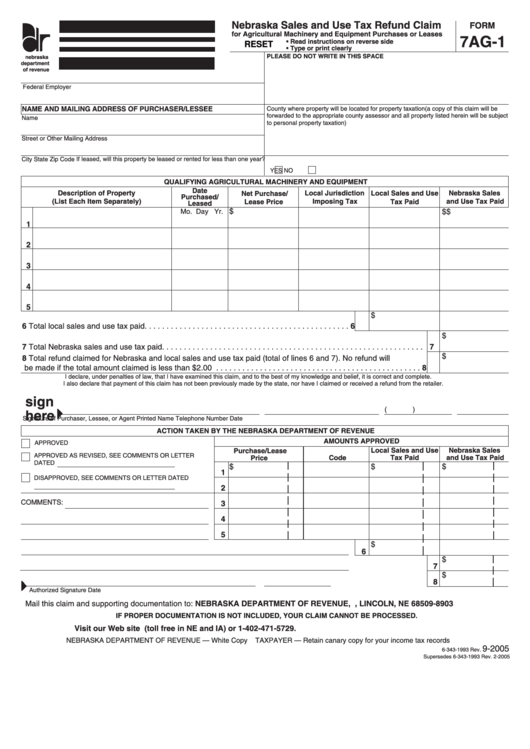

Nebraska Sales and Use Tax Refund Claim

FORM

for Agricultural Machinery and Equipment Purchases or Leases

7AG-1

• Read instructions on reverse side

RESET

• Type or print clearly

PLEASE DO NOT WRITE IN THIS SPACE

nebraska

department

of revenue

Federal Employer I.D. or Social Security Number

NAME AND MAILING ADDRESS OF PURCHASER/LESSEE

County where property will be located for property taxation (a copy of this claim will be

forwarded to the appropriate county assessor and all property listed herein will be subject

Name

to personal property taxation)

Street or Other Mailing Address

City

State

Zip Code

If leased, will this property be leased or rented for less than one year?

YES

NO

QUALIFYING AGRICULTURAL MACHINERY AND EQUIPMENT

Date

Description of Property

Local Jurisdiction

Nebraska Sales

Net Purchase/

Local Sales and Use

Purchased/

(List Each Item Separately)

Imposing Tax

Tax Paid

and Use Tax Paid

Lease Price

Leased

$

$

$

Mo. Day Yr.

1

2

3

4

5

$

6 Total local sales and use tax paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

$

7 Total Nebraska sales and use tax paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

$

8 Total refund claimed for Nebraska and local sales and use tax paid (total of lines 6 and 7). No refund will

be made if the total amount claimed is less than $2.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

I declare, under penalties of law, that I have examined this claim, and to the best of my knowledge and belief, it is correct and complete.

I also declare that payment of this claim has not been previously made by the state, nor have I claimed or received a refund from the retailer.

sign

(

)

here

Signature of Purchaser, Lessee, or Agent

Printed Name

Telephone Number

Date

ACTION TAKEN BY THE NEBRASKA DEPARTMENT OF REVENUE

AMOUNTS APPROVED

APPROVED

Purchase/Lease

Local Sales and Use

Nebraska Sales

APPROVED AS REVISED, SEE COMMENTS OR LETTER

Price

Code

Tax Paid

and Use Tax Paid

DATED

$

$

$

1

DISAPPROVED, SEE COMMENTS OR LETTER DATED

2

COMMENTS:

3

4

5

$

6

$

7

$

8

Authorized Signature

Date

Mail this claim and supporting documentation to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 98903, LINCOLN, NE 68509-8903

IF PROPER DOCUMENTATION IS NOT INCLUDED, YOUR CLAIM CANNOT BE PROCESSED.

Visit our Web site or call 1-800-742-7474 (toll free in NE and IA) or 1-402-471-5729.

NEBRASKA DEPARTMENT OF REVENUE — White Copy

TAXPAYER — Retain canary copy for your income tax records

9-2005

6-343-1993 Rev.

Supersedes 6-343-1993 Rev. 2-2005

1

1 2

2