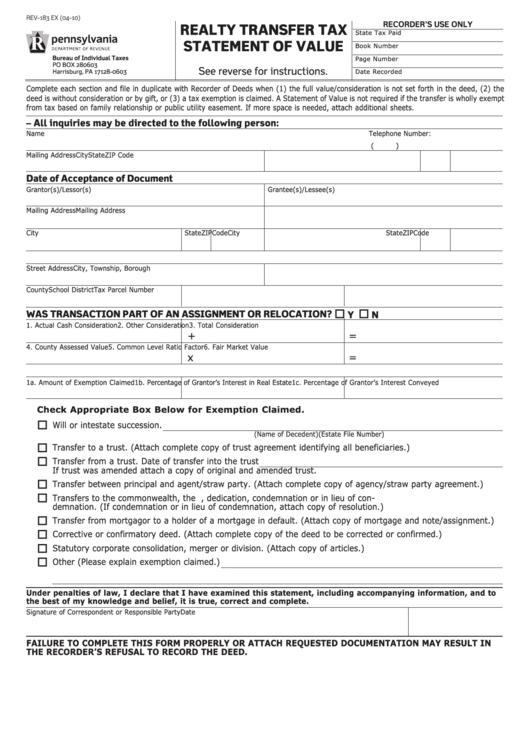

REV-183 EX (04-10)

RECORDER’S USE ONLY

REALTY TRANSFER TAX

State Tax Paid

STATEMENT OF VALUE

Book Number

Bureau of Individual Taxes

Page Number

PO BOX 280603

See reverse for instructions.

Harrisburg, PA 17128-0603

Date Recorded

Complete each section and file in duplicate with Recorder of Deeds when (1) the full value/consideration is not set forth in the deed, (2) the

deed is without consideration or by gift, or (3) a tax exemption is claimed. A Statement of Value is not required if the transfer is wholly exempt

from tax based on family relationship or public utility easement. If more space is needed, attach additional sheets.

A. CORRESPONDENT – All inquiries may be directed to the following person:

Name

Telephone Number:

(

)

Mailing Address

City

State

ZIP Code

B. TRANSFER DATA

C. Date of Acceptance of Document

Grantor(s)/Lessor(s)

Grantee(s)/Lessee(s)

Mailing Address

Mailing Address

City

State

ZIP Code

City

State

ZIP Code

D. REAL ESTATE LOCATION

Street Address

City, Township, Borough

County

School District

Tax Parcel Number

E. VALUATION DATA - WAS TRANSACTION PART OF AN ASSIGNMENT OR RELOCATION?

Y

N

1. Actual Cash Consideration

2. Other Consideration

3. Total Consideration

+

=

4. County Assessed Value

5. Common Level Ratio Factor

6. Fair Market Value

=

x

F. EXEMPTION DATA

1a. Amount of Exemption Claimed

1b. Percentage of Grantor’s Interest in Real Estate 1c. Percentage of Grantor’s Interest Conveyed

Check Appropriate Box Below for Exemption Claimed.

Will or intestate succession.

(Name of Decedent)

(Estate File Number)

Transfer to a trust. (Attach complete copy of trust agreement identifying all beneficiaries.)

Transfer from a trust. Date of transfer into the trust

If trust was amended attach a copy of original and amended trust.

Transfer between principal and agent/straw party. (Attach complete copy of agency/straw party agreement.)

Transfers to the commonwealth, the U.S. and instrumentalities by gift, dedication, condemnation or in lieu of con-

demnation. (If condemnation or in lieu of condemnation, attach copy of resolution.)

Transfer from mortgagor to a holder of a mortgage in default. (Attach copy of mortgage and note/assignment.)

Corrective or confirmatory deed. (Attach complete copy of the deed to be corrected or confirmed.)

Statutory corporate consolidation, merger or division. (Attach copy of articles.)

Other (Please explain exemption claimed.)

Under penalties of law, I declare that I have examined this statement, including accompanying information, and to

the best of my knowledge and belief, it is true, correct and complete.

Signature of Correspondent or Responsible Party

Date

FAILURE TO COMPLETE THIS FORM PROPERLY OR ATTACH REQUESTED DOCUMENTATION MAY RESULT IN

THE RECORDER’S REFUSAL TO RECORD THE DEED.

1

1 2

2