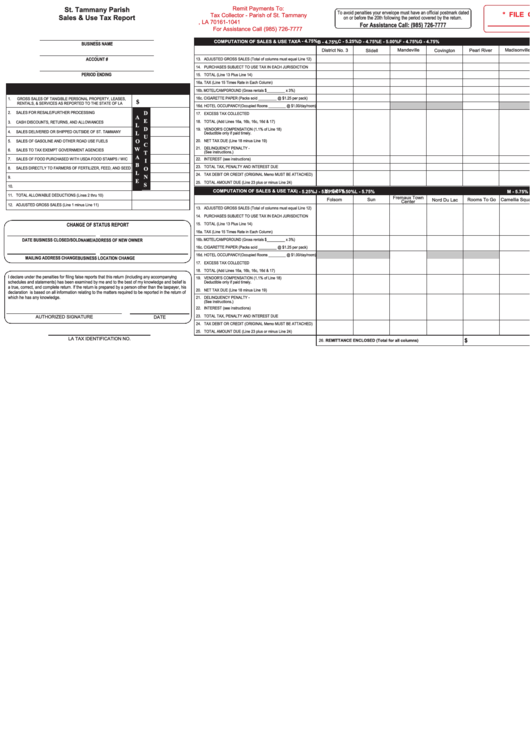

St. Tammany Parish Sales & Use Tax Report

ADVERTISEMENT

Remit Payments To:

St. Tammany Parish

To avoid penalties your envelope must have an official postmark dated

* FILE ONLINE

Tax Collector - Parish of St. Tammany

Sales & Use Tax Report

on or before the 20th following the period covered by the return.

P.O. Box 61041 - New Orleans, LA 70161-1041

For Assistance Call: (985) 726-7777

For Assistance Call (985) 726-7777

_

COMPUTATION OF SALES & USE TAX

A - 4.75%

C - 5.25%

G - 4.75%

B - 4.75%

D - 4.75%

E - 5.00%

F - 4.75%

BUSINESS NAME

Mandeville

Abita Springs

District No. 3

Slidell

Covington

Pearl River

Madisonville

_

ACCOUNT #

13. ADJUSTED GROSS SALES (Total of columns must equal Line 12)

14. PURCHASES SUBJECT TO USE TAX IN EACH JURISDICTION

_

PERIOD ENDING

15. TOTAL (Line 13 Plus Line 14)

16a. TAX (Line 15 Times Rate in Each Column)

16b. MOTEL/CAMPGROUND (Gross rentals $_________ x 3%)

16c. CIGARETTE PAPER (Packs sold _________ @ $1.25 per pack)

1.

GROSS SALES OF TANGIBLE PERSONAL PROPERTY, LEASES,

$

RENTALS, & SERVICES AS REPORTED TO THE STATE OF LA

16d. HOTEL OCCUPANCY (Occupied Rooms _________ @ $1.00/day/room)

D

2.

SALES FOR RESALE/FURTHER PROCESSING

17. EXCESS TAX COLLECTED

A

E

18. TOTAL (Add Lines 16a, 16b, 16c, 16d & 17)

3.

CASH DISCOUNTS, RETURNS, AND ALLOWANCES

L

D

19. VENDOR'S COMPENSATION (1.1% of Line 18)

L

4.

SALES DELIVERED OR SHIPPED OUTSIDE OF ST. TAMMANY

Deductible only if paid timely.

U

O

20. NET TAX DUE (Line 18 minus Line 19)

5.

SALES OF GASOLINE AND OTHER ROAD USE FUELS

C

W

21. DELINQUENCY PENALTY -

6.

SALES TO TAX EXEMPT GOVERNMENT AGENCIES

T

(See instructions.)

A

7.

SALES OF FOOD PURCHASED WITH USDA FOOD STAMPS / WIC

22. INTEREST (see instructions)

I

B

23. TOTAL TAX, PENALTY AND INTEREST DUE

O

8.

SALES DIRECTLY TO FARMERS OF FERTILIZER, FEED, AND SEED

L

24. TAX DEBIT OR CREDIT (ORIGINAL Memo MUST BE ATTACHED)

N

9.

E

25. TOTAL AMOUNT DUE (Line 23 plus or minus Line 24)

S

10.

COMPUTATION OF SALES & USE TAX

H - 5.25%

I - 5.25%

J - 5.25%

K - 5.50%

L - 5.75%

M - 5.75%

N - 5.25%

11. TOTAL ALLOWABLE DEDUCTIONS (Lines 2 thru 10)

Fremaux Town

Northshore

Folsom

Sun

Nord Du Lac

Rooms To Go

Camellia Square

Center

Square

12. ADJUSTED GROSS SALES (Line 1 minus Line 11)

13. ADJUSTED GROSS SALES (Total of columns must equal Line 12)

14. PURCHASES SUBJECT TO USE TAX IN EACH JURISDICTION

CHANGE OF STATUS REPORT

15. TOTAL (Line 13 Plus Line 14)

16a. TAX (Line 15 Times Rate in Each Column)

DATE BUSINESS CLOSED/SOLD

NAME/ADDRESS OF NEW OWNER

16b. MOTEL/CAMPGROUND (Gross rentals $_________ x 3%)

16c. CIGARETTE PAPER (Packs sold _________ @ $1.25 per pack)

16d. HOTEL OCCUPANCY (Occupied Rooms _________ @ $1.00/day/room)

MAILING ADDRESS CHANGE

BUSINESS LOCATION CHANGE

17. EXCESS TAX COLLECTED

18. TOTAL (Add Lines 16a, 16b, 16c, 16d & 17)

I declare under the penalties for filing false reports that this return (including any accompanying

19. VENDOR'S COMPENSATION (1.1% of Line 18)

schedules and statements) has been examined by me and to the best of my knowledge and belief is

Deductible only if paid timely.

a true, correct, and complete return. If the return is prepared by a person other than the taxpayer, his

20. NET TAX DUE (Line 18 minus Line 19)

declaration is based on all information relating to the matters required to be reported in the return of

which he has any knowledge.

21. DELINQUENCY PENALTY -

(See instructions.)

22. INTEREST (see instructions)

23. TOTAL TAX, PENALTY AND INTEREST DUE

AUTHORIZED SIGNATURE

DATE

24. TAX DEBIT OR CREDIT (ORIGINAL Memo MUST BE ATTACHED)

25. TOTAL AMOUNT DUE (Line 23 plus or minus Line 24)

LA TAX IDENTIFICATION NO.

$

26. REMITTANCE ENCLOSED (Total for all columns)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1