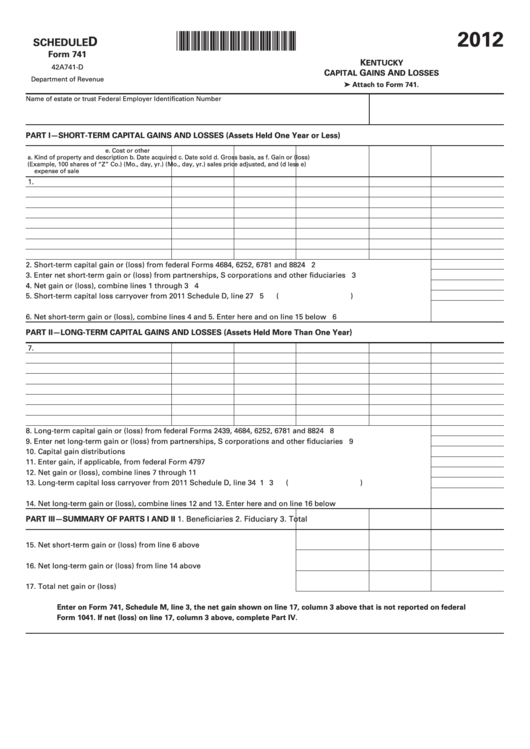

Schedule D Form 741 - Kentucky Capital Gains And Losses - 2012

ADVERTISEMENT

2012

*1200020031*

D

SCHEDULE

Form 741

K

ENTUCKY

42A741-D

C

G

A

L

APITAL

AINS

ND

OSSES

Department of Revenue

➤ Attach to Form 741.

Name of estate or trust

Federal Employer Identification Number

PART I—SHORT-TERM CAPITAL GAINS AND LOSSES (Assets Held One Year or Less)

e. Cost or other

a. Kind of property and description

b. Date acquired

c. Date sold

d. Gross

basis, as

f. Gain or (loss)

(Example, 100 shares of “Z” Co.)

(Mo., day, yr.)

(Mo., day, yr.)

sales price

adjusted, and

(d less e)

expense of sale

1.

2. Short-term capital gain or (loss) from federal Forms 4684, 6252, 6781 and 8824 .................................................... 2

3. Enter net short-term gain or (loss) from partnerships, S corporations and other fiduciaries ................................. 3

4. Net gain or (loss), combine lines 1 through 3 ............................................................................................................. 4

5. Short-term capital loss carryover from 2011 Schedule D, line 27 ............................................................................. 5 (

)

6. Net short-term gain or (loss), combine lines 4 and 5. Enter here and on line 15 below .......................................... 6

PART II—LONG-TERM CAPITAL GAINS AND LOSSES (Assets Held More Than One Year)

7.

8. Long-term capital gain or (loss) from federal Forms 2439, 4684, 6252, 6781 and 8824 ........................................... 8

9. Enter net long-term gain or (loss) from partnerships, S corporations and other fiduciaries .................................. 9

10. Capital gain distributions ............................................................................................................................................. 10

11. Enter gain, if applicable, from federal Form 4797 ...................................................................................................... 11

12. Net gain or (loss), combine lines 7 through 11 .......................................................................................................... 12

13. Long-term capital loss carryover from 2011 Schedule D, line 34 ............................................................................. 13 (

)

14. Net long-term gain or (loss), combine lines 12 and 13. Enter here and on line 16 below ...................................... 14

PART III—SUMMARY OF PARTS I AND II

1. Beneficiaries

2. Fiduciary

3. Total

15. Net short-term gain or (loss) from line 6 above ....................................... 15

16. Net long-term gain or (loss) from line 14 above ...................................... 16

17. Total net gain or (loss) ................................................................................ 17

Enter on Form 741, Schedule M, line 3, the net gain shown on line 17, column 3 above that is not reported on federal

Form 1041. If net (loss) on line 17, column 3 above, complete Part IV.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2