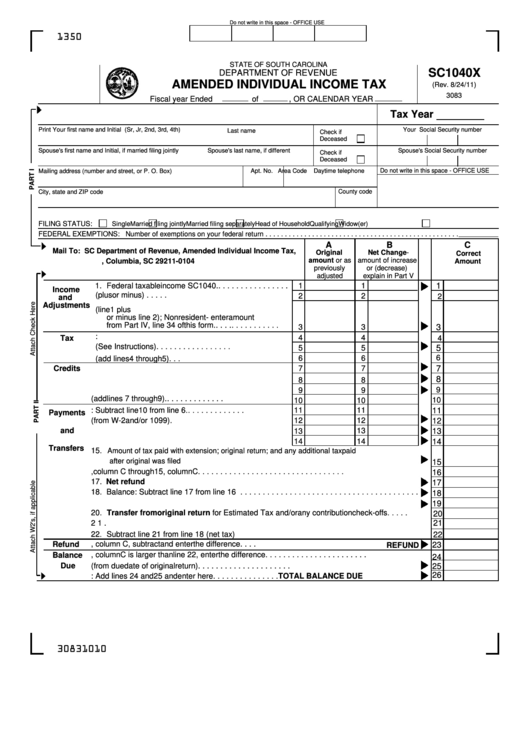

Form Sc1040x - Amended Individual Income Tax

ADVERTISEMENT

Do not write in this space - OFFICE USE

1350

STATE OF SOUTH CAROLINA

SC1040X

DEPARTMENT OF REVENUE

AMENDED INDIVIDUAL INCOME TAX

(Rev. 8/24/11)

3083

Fiscal year Ended

of

, OR CALENDAR YEAR

Tax Year

Print Your first name and Initial (Sr, Jr, 2nd, 3rd, 4th)

Your Social Security number

Last name

Check if

Deceased

Spouse's first name and Initial, if married filing jointly

Spouse's last name, if different

Spouse's Social Security number

Check if

Deceased

Do not write in this space - OFFICE USE

Mailing address (number and street, or P. O. Box)

Apt. No.

Area Code

Daytime telephone

County code

City, state and ZIP code

FILING STATUS:

Single

Married filing jointly

Married filing separately

Head of Household

Qualifying Widow(er)

FEDERAL EXEMPTIONS: Number of exemptions on your federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A

B

C

Mail To: SC Department of Revenue, Amended Individual Income Tax,

Original

Net Change-

Correct

amount or as

amount of increase

P.O. Box 101104, Columbia, SC 29211-0104

Amount

previously

or (decrease)

adjusted

explain in Part V

1

1.

Federal taxable income SC1040. . . . . . . . . . . . . . . . .

1

1

Income

2. Net South Carolina adjustment (plus or minus) . . . . .

2

2

2

and

Adjustments

3. Modified South Carolina taxable income (line 1 plus

or minus line 2); Nonresident - enter amount

from Part IV, line 34 of this form . . . . . . . . . . . . . . .

.

3

3

3

4. South Carolina Tax: . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

Tax

4

5. Other Taxes (See Instructions) . . . . . . . . . . . . . . . . .

5

5

5

6

6

6

6. Total South Carolina Tax (add lines 4 through 5) . . .

Credits

7. Child and Dependent Care Credit . . . . . . . . . . . . . . . .

7

7

7

8. Two Wage Earner Credit . . . . . . . . . . . . . . . . . . . . . .

8

8

8

9. Other Non-Refundable Credits . . . . . . . . . . . . . . . . . .

9

9

9

10. Total Credits (add lines 7 through 9). . . . . . . . . . . . . .

10

10

10

11. Balance: Subtract line 10 from line 6. . . . . . . . . . . . . .

11

11

11

Payments

12. South Carolina tax withheld (from W-2 and/or 1099) .

12

12

12

13. South Carolina estimated tax payments . . . . . . . . . . .

and

13

13

13

14. Tuition Tax Credit and other refundable credits. . . . . .

14

14

14

Transfers

15.

Amount of tax paid with extension

;

original return; and any additional tax paid

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

after original was filed

15

16. Total of line 12, column C through 15, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Net refund from original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Balance: Subtract line 17 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Amount of Use Tax from out-of-state purchases as recorded on original return . . . . . . . . .

19

20. Transfer from original return for Estimated Tax and/or any contribution check-offs . . . . .

20

21. Add lines 19 and 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22

Subtract line 21 from line 18 (net tax)

.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Refund

23. If line 22 is larger than line 11, column C, subtract and enter the difference . . . .

REFUND

23

24. If line 11, column C is larger than line 22, enter the difference . . . . . . . . . . . . . . . . . . . . . . .

Balance

24

Due

25. Interest and penalty on tax due (from due date of original return) . . . . . . . . . . . . . . . . . . . . .

25

26

26. TOTAL: Add lines 24 and 25 and enter here . . . . . . . . . . . . . . . TOTAL BALANCE DUE

30831010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5