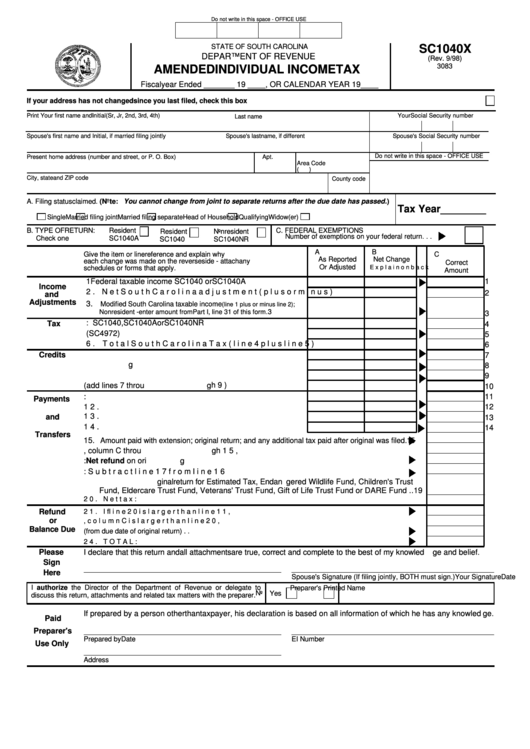

Form Sc1040x - Amended Individual Income Tax

ADVERTISEMENT

Do not write in this space - OFFICE USE

STATE OF SOUTH CAROLINA

SC1040X

DEPARTMENT OF REVENUE

(Rev. 9/98)

3083

AMENDED INDIVIDUAL INCOME TAX

Fiscal year Ended _______ 19 ____, OR CALENDAR YEAR 19 ____

If your address has not changed since you last filed, check this box ......................................................................................................................

Print Your first name and Initial

(Sr, Jr, 2nd, 3rd, 4th)

Your Social Security number

Last name

Spouse's first name and Initial, if married filing jointly

Spouse's last name, if different

Spouse's Social Security number

Do not write in this space - OFFICE USE

Present home address (number and street, or P. O. Box)

Apt. No.

Daytime telephone

Area Code

(

)

City, state and ZIP code

County code

A. Filing status claimed. (Note: You cannot change from joint to separate returns after the due date has passed. )

Tax Year ________

Single

Married filing joint

Married filing separate

Head of Household

Qualifying Widow(er)

B. TYPE OF RETURN:

Resident

C. FEDERAL EXEMPTIONS

Resident

Nonresident

Number of exemptions on your federal return . . .

Check one

SC1040A

SC1040

SC1040NR

A

B

Give the item or line reference and explain why

C

As Reported

Net Change

each change was made on the reverse side - attach any

Correct

Or Adjusted

Explain on back

schedules or forms that apply.

Amount

1

Federal taxable income SC1040 or SC1040A . . . . . . .

1

1

Income

2. Net South Carolina adjustment (plus or minus) . . . . . .

2

2

and

Adjustments

3.

Modified South Carolina taxable income

(line 1 plus or minus line 2);

Nonresident - enter amount from Part I, line 31 of this form.

3

3

4. Tax: SC1040, SC1040A or SC1040NR . . . . . . . . . . .

4

Tax

4

5. Tax on lump sum distribution (SC4972) . . . . . . . . . . . . 5

5

6. Total South Carolina Tax (line 4 plus line 5) . . . . . . . . . 6

6

7. Child and Dependent Care Credit . . . . . . . . . . . . . . . . . 7

Credits

7

8. Two Wage Earner Credit . . . . . . . . . . . . . . . . . . . . . . . . 8

8

9. Other Non-Refundable Credits . . . . . . . . . . . . . . . . . . .

9

9

10. Total Credits (add lines 7 through 9) . . . . . . . . . . . . . . 10

10

11. Balance: Subtract line 10 from line 6 . . . . . . . . . . . . . . . 11

11

Payments

12. South Carolina tax withheld . . . . . . . . . . . . . . . . . . . . . . 12

12

13. South Carolina estimated tax payments . . . . . . . . . . . . . 13

and

13

14. Tuition Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

14

Transfers

15.

;

Amount paid with extension

original return; and any additional tax paid after original was filed.

15

16. Total of lines 12, column C through 15, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Less: Net refund on original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Balance: Subtract line 17 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Transfer from original return for Estimated Tax, Endangered Wildlife Fund, Children's Trust

Fund, Eldercare Trust Fund, Veterans' Trust Fund, Gift of Life Trust Fund or DARE Fund . . 19

20. Net tax: Subtract line 19 from line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Refund

21. If line 20 is larger than line 11, column C. Enter the REFUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

or

22. If line 11, column C is larger than line 20, enter the difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Balance Due

23. Interest and penalty on tax due (from due date of original return) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24. TOTAL: Add lines 22 and 23 and enter the TOTAL BALANCE DUE . . . . . . . . . . . . . . . . . . . . . . . . . .

24

Please

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Sign

Here

Your Signature

Date

Spouse's Signature (If filing jointly, BOTH must sign.)

I authorize the Director of the Department of Revenue or delegate to

Preparer's Printed Name

Yes

No

discuss this return, attachments and related tax matters with the preparer.

If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

Paid

Preparer's

Prepared by

Date

EI Number

Use Only

Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2