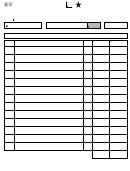

Division use only — DLN Stamp

Division use only — Date Stamp

Attach To:

Month

Year

Form SMF100,

Pursuant to NJSA 54:39-101 et seq

Supplier Schedule of Motor Fuels Tax Due

10-2010

SMF400

Airport Safety Tax Liability Schedule

Supplier

Supplier ID #

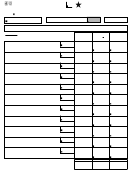

Tax-free Aviation Fuel Sales - in Gallons

Sales of Aviation Fuel made to Government Entities

1

From Form SMF101, SMF201

Sales of Aviation Fuel Exported Directly from the Rack

2

From Form SMF102, SMF202

Aviation Gasoline destined for International Airports in New Jersey

3

From Form SMF112B

Taxable Aviation Kerosene Sales made to a licensed Aviation Fuel Dealer

4

From Form SMF212C

Taxable Aviation Gasoline Sales made to an licensed Aviation Fuel Dealer

5

From Form SMF112C

Total Exempt Sales

6

Sum of Lines 1 through 5

Taxable Sales of Aviation Fuel Destined for New Jersey - in Gallons

Taxable Sales Aviation Kerosene distributed to a New Jersey GAA

7

From Form SMF212A

Taxable Sales Aviation Gasoline distributed to a New Jersey GAA

8

From Form SMF112A

Taxable Aviation Kerosene Sales made to an Unlicensed Aviation Fuel Dealer

9

From Form SMF204 or SMF205

Taxable Aviation Gasoline Sales made to an Unlicensed Aviation Fuel Dealer

10

From Form SMF 104 or SMF105

Diversion Correction - Aviation Fuel Diverted from New Jersey

11

(

)

From Form SMF110, SMF 210

Diversion Correction - Aviation Fuel Diverted into New Jersey

12

From Form SMF111, SMF 211

Total Taxable Sales of Aviation Fuel Distributed to General Aviation

13

Airports - Sum of Lines 7 through 12

X 2¢

Calculation of Tax

Tax Liability for Aviation Fuel for distribution to General Aviation Airports

14

Multiply line 13 by $.02

Credit for previous month's overpayment

15

(

)

From Line 19 of last month's SMF400

Credit for Delinquent Distributors

16

(

)

From Form SMF407

Credit for Gallons of Aviation Fuel Purchased with Tax Included

17

(

)

From Form SMF408

Tax Due for Aviation Fuel

18

Subtract lines 15, 16, & 17 from Line 14. If amount is less than zero, enter 0

& enter the amount to credit on line 19

Put this amount on

Amount to Credit to Next Period

Line 4, Form SMF-10

$

19

Enter this amount on Line 15 of next month's SMF400

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31