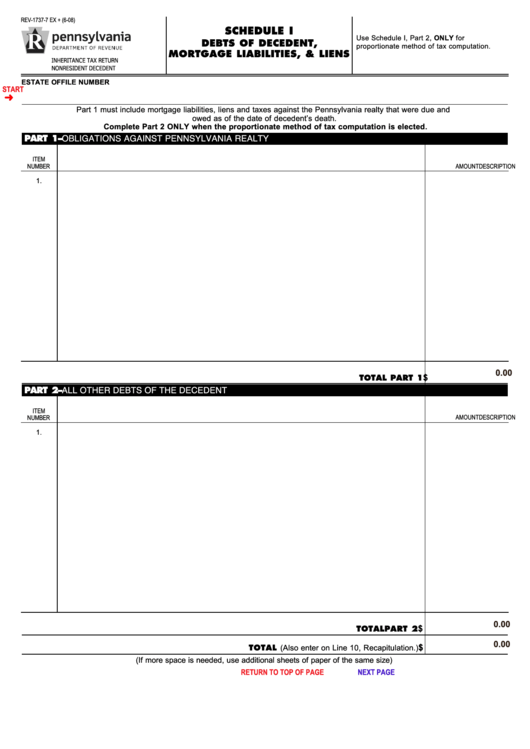

Form Rev-1737-7 Ex + - Schedule I Debts Of Decedent, Mortgage Liabilities, & Liens

ADVERTISEMENT

REV-1737-7 EX + (6-08)

SCHEDULE I

Use Schedule I, Part 2, ONLY for

DEBTS OF DECEDENT,

proportionate method of tax computation.

MORTGAGE LIABILITIES, & LIENS

INHERITANCE TAX RETURN

NONRESIDENT DECEDENT

ESTATE OF

FILE NUMBER

START

Part 1 must include mortgage liabilities, liens and taxes against the Pennsylvania realty that were due and

owed as of the date of decedent’s death.

Complete Part 2 ONLY when the proportionate method of tax computation is elected.

PART 1 – OBLIGATIONS AGAINST PENNSYLVANIA REALTY

ITEM

NUMBER

DESCRIPTION

AMOUNT

1.

0.00

TOTAL PART 1

$

PART 2 – ALL OTHER DEBTS OF THE DECEDENT

ITEM

DESCRIPTION

AMOUNT

NUMBER

1.

0.00

TOTAL PART 2

$

0.00

TOTAL (Also enter on Line 10, Recapitulation.)

$

(If more space is needed, use additional sheets of paper of the same size)

RETURN TO TOP OF PAGE

NEXT PAGE

Reset Entire Form

PRINT FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2