Form Rev-1737-5 Ex + - Schedule F, Jointly-Owned Property

ADVERTISEMENT

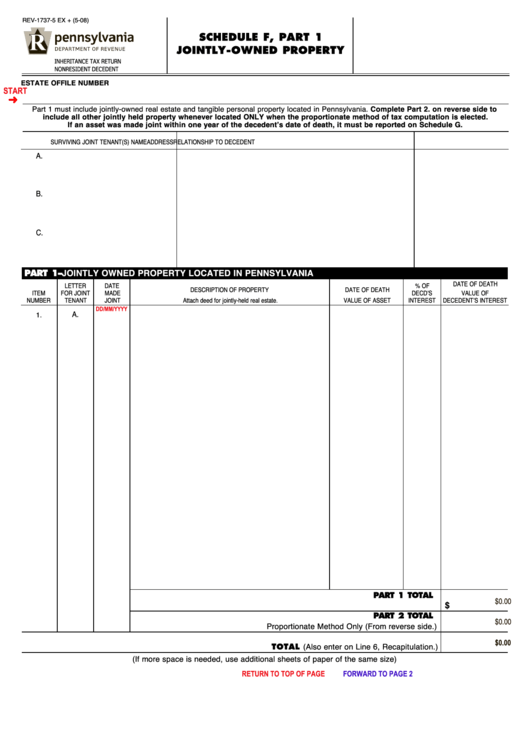

REV-1737-5 EX + (5-08)

SCHEDULE F, PART 1

JOINTLY-OWNED PROPERTY

INHERITANCE TAX RETURN

NONRESIDENT DECEDENT

ESTATE OF

FILE NUMBER

START

Part 1 must include jointly-owned real estate and tangible personal property located in Pennsylvania. Complete Part 2. on reverse side to

include all other jointly held property whenever located ONLY when the proportionate method of tax computation is elected.

If an asset was made joint within one year of the decedentʼs date of death, it must be reported on Schedule G.

SURVIVING JOINT TENANT(S) NAME

ADDRESS

RELATIONSHIP TO DECEDENT

A.

B.

C.

PART 1 – JOINTLY OWNED PROPERTY LOCATED IN PENNSYLVANIA

DATE OF DEATH

LETTER

DATE

% OF

DESCRIPTION OF PROPERTY

DATE OF DEATH

ITEM

FOR JOINT

MADE

DECDʼS

VALUE OF

NUMBER

TENANT

JOINT

Attach deed for jointly-held real estate.

VALUE OF ASSET

INTEREST

DECEDENTʼS INTEREST

DD/MM/YYYY

A.

1.

PART 1 TOTAL

$0.00

$

PART 2 TOTAL

$0.00

Proportionate Method Only (From reverse side.)

$0.00

TOTAL (Also enter on Line 6, Recapitulation.)

(If more space is needed, use additional sheets of paper of the same size)

RETURN TO TOP OF PAGE

FORWARD TO PAGE 2

PRINT FORM

Reset Entire Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2