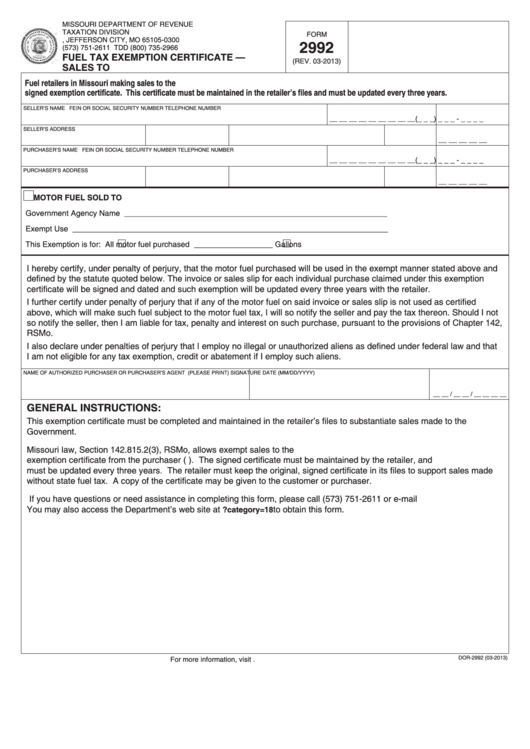

MISSOURI DEPARTMENT OF REVENUE

Print Form

Reset Form

TAXATION DIVISION

FORM

P.O. BOX 300, JEFFERSON CITY, MO 65105-0300

2992

(573) 751-2611 TDD (800) 735-2966

FUEL TAX EXEMPTION CERTIFICATE —

(REV. 03-2013)

SALES TO U.S. GOVERNMENT

Fuel retailers in Missouri making sales to the U.S. Government may make such sales without charging fuel tax if the retailer has obtained a

signed exemption certificate. This certificate must be maintained in the retailer’s files and must be updated every three years.

SELLER’S NAME

FEIN OR SOCIAL SECURITY NUMBER

TELEPHONE NUMBER

(_ _ _) _ _ _ - _ _ _ _

__ __ __ __ __ __ __ __ __

SELLER’S ADDRESS

P.O. BOX

CITY

STATE

ZIP

__ __ __ __ __

PURCHASER’S NAME

FEIN OR SOCIAL SECURITY NUMBER

TELEPHONE NUMBER

__ __ __ __ __ __ __ __ __

(_ _ _) _ _ _ - _ _ _ _

PURCHASER’S ADDRESS

P.O. BOX

CITY

STATE

ZIP

__ __ __ __ __

MOTOR FUEL SOLD TO U.S. GOVERNMENT

Government Agency Name ____________________________________________________________

Exempt Use ________________________________________________________________________

This Exemption is for:

All motor fuel purchased

__________________ Gallons

I hereby certify, under penalty of perjury, that the motor fuel purchased will be used in the exempt manner stated above and

defined by the statute quoted below. The invoice or sales slip for each individual purchase claimed under this exemption

certificate will be signed and dated and such exemption will be updated every three years with the retailer.

I further certify under penalty of perjury that if any of the motor fuel on said invoice or sales slip is not used as certified

above, which will make such fuel subject to the motor fuel tax, I will so notify the seller and pay the tax thereon. Should I not

so notify the seller, then I am liable for tax, penalty and interest on such purchase, pursuant to the provisions of Chapter 142,

RSMo.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that

I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

NAME OF AUTHORIZED PURCHASER OR PURCHASER’S AGENT (PLEASE PRINT)

SIGNATURE

DATE (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

GENERAL INSTRUCTIONS:

This exemption certificate must be completed and maintained in the retailer’s files to substantiate sales made to the U.S.

Government.

Missouri law, Section 142.815.2(3), RSMo, allows exempt sales to the U.S. Government. The seller must obtain a signed

exemption certificate from the purchaser (U.S. Government). The signed certificate must be maintained by the retailer, and

must be updated every three years. The retailer must keep the original, signed certificate in its files to support sales made

without state fuel tax. A copy of the certificate may be given to the customer or purchaser.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov.

You may also access the Department’s web site at

to obtain this form.

DOR-2992 (03-2013)

For more information, visit

1

1