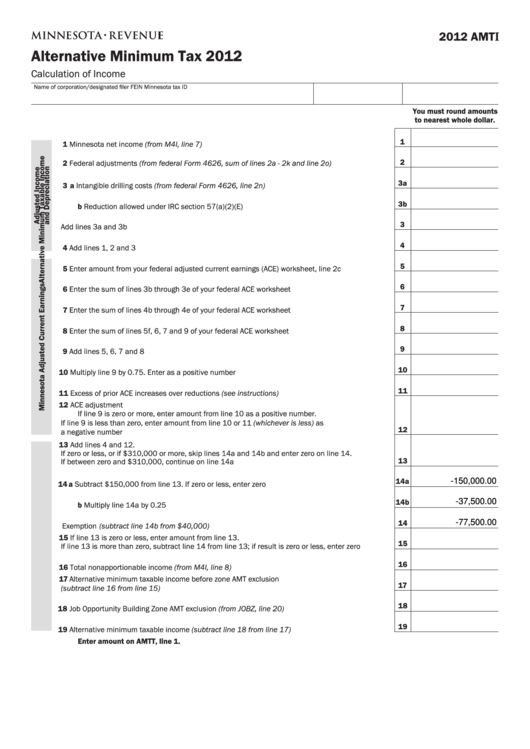

2012 AMT I

Alternative Minimum Tax 2012

Calculation of Income

Name of corporation/designated filer

FEIN

Minnesota tax ID

You must round amounts

to nearest whole dollar.

1

1 Minnesota net income (from M4I, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Federal adjustments (from federal Form 4626, sum of lines 2a - 2k and line 2o) . . . . . . . . . . . . . .

3a

3 a Intangible drilling costs (from federal Form 4626, line 2n) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

b Reduction allowed under IRC section 57(a)(2)(E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Add lines 3a and 3b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Add lines 1, 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Enter amount from your federal adjusted current earnings (ACE) worksheet, line 2c . . . . . . . . . . . .

6

6 Enter the sum of lines 3b through 3e of your federal ACE worksheet . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Enter the sum of lines 4b through 4e of your federal ACE worksheet . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Enter the sum of lines 5f, 6, 7 and 9 of your federal ACE worksheet . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Add lines 5, 6, 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Multiply line 9 by 0 .75 . Enter as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Excess of prior ACE increases over reductions (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 ACE adjustment

If line 9 is zero or more, enter amount from line 10 as a positive number .

If line 9 is less than zero, enter amount from line 10 or 11 (whichever is less) as

12

a negative number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Add lines 4 and 12 .

If zero or less, or if $310,000 or more, skip lines 14a and 14b and enter zero on line 14 .

13

If between zero and $310,000, continue on line 14a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14a

-150,000.00

14 a Subtract $150,000 from line 13 . If zero or less, enter zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14b

-37,500.00

b Multiply line 14a by 0 .25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

-77,500.00

Exemption (subtract line 14b from $40,000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 If line 13 is zero or less, enter amount from line 13 .

15

If line 13 is more than zero, subtract line 14 from line 13; if result is zero or less, enter zero . . . . .

16

16 Total nonapportionable income (from M4I, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Alternative minimum taxable income before zone AMT exclusion

17

(subtract line 16 from line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18 Job Opportunity Building Zone AMT exclusion (from JOBZ, line 20) . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19 Alternative minimum taxable income (subtract line 18 from line 17) . . . . . . . . . . . . . . . . . . . . . . . . .

Enter amount on AMTT, line 1.

1

1 2

2