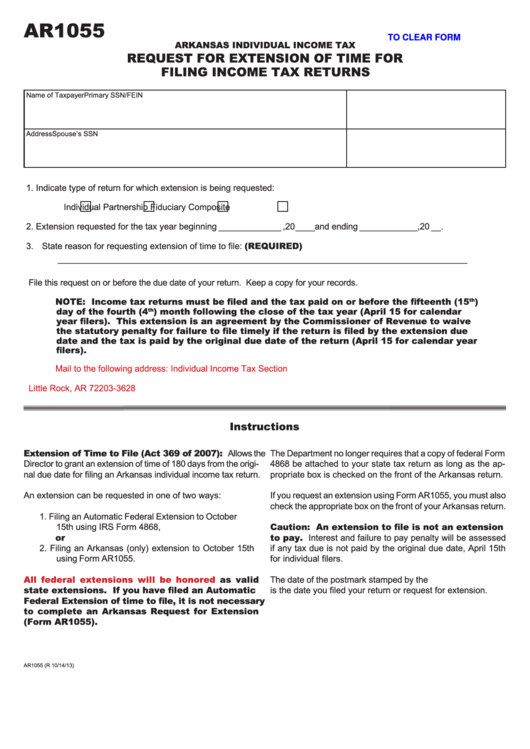

AR1055

CLICK HERE TO CLEAR FORM

ARKANSAS INDIVIDUAL INCOME TAX

REQUEST FOR EXTENSION OF TIME FOR

FILING INCOME TAX RETURNS

Name of Taxpayer

Primary SSN/FEIN

Address

Spouse’s SSN

1. Indicate type of return for which extension is being requested:

Individual

Partnership

Fiduciary

Composite

2. Extension requested for the tax year beginning _____________ ,20 ____ and ending ____________,20 __ .

3. State reason for requesting extension of time to file: (REQUIRED)

_____________________________________________________________________________________

File this request on or before the due date of your return. Keep a copy for your records.

NOTE: Income tax returns must be filed and the tax paid on or before the fifteenth (15

)

th

day of the fourth (4

) month following the close of the tax year (April 15 for calendar

th

year filers). This extension is an agreement by the Commissioner of Revenue to waive

the statutory penalty for failure to file timely if the return is filed by the extension due

date and the tax is paid by the original due date of the return (April 15 for calendar year

filers).

Mail to the following address:

Individual Income Tax Section

P.O. Box 3628

Little Rock, AR 72203-3628

Instructions

Extension of Time to File (Act 369 of 2007): Allows the

The Department no longer requires that a copy of federal Form

Director to grant an extension of time of 180 days from the origi-

4868 be attached to your state tax return as long as the ap-

nal due date for filing an Arkansas individual income tax return.

propriate box is checked on the front of the Arkansas return.

An extension can be requested in one of two ways:

If you request an extension using Form AR1055, you must also

check the appropriate box on the front of your Arkansas return.

1. Filing an Automatic Federal Extension to October

Caution: An extension to file is not an extension

15th using IRS Form 4868,

or

to pay. Interest and failure to pay penalty will be assessed

2. Filing an Arkansas (only) extension to October 15th

if any tax due is not paid by the original due date, April 15th

using Form AR1055.

for individual filers.

All federal extensions will be

honored as valid

The date of the postmark stamped by the U.S. Postal Service

state extensions. If you have filed an Automatic

is the date you filed your return or request for extension.

Federal Extension of time to file, it is not necessary

to complete an Arkansas Request for Extension

(Form AR1055).

AR1055 (R 10/14/13)

1

1