CT-115 INSTRUCTIONS

WHO MUST COMPLETE THIS SCHEDULE

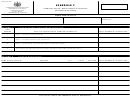

Madison Office Location

2135 Rimrock Road

This schedule must be completed by all cigarette distribu-

Madison, WI 53713

tors who sell stamped cigarettes to retail stores authorized

to sell cigarettes by federally recognized Native American

Mailing Address

Indian Tribes occupying reservation/trust lands in Wiscon-

Excise Tax Section 6-107

sin. This schedule should also be used to report stamped

Wisconsin Department of Revenue

cigarettes returned by the authorized tribal retail stores. If

PO Box 8900

cigarettes are sold to authorized tribal retailers, obtain a

Madison WI 53708-8900

letter from the tribe stating the names and addresses of

the tribe’s authorized cigarette retailers File this schedule

Phone: (608) 266-8970

electronically as an attachement to Form CT-100 or CT-

Fax: (608) 261-7049

105 as needed. These forms are located at

E-mail: excise@revenue.wi.gov

wi.gov/html/cigtob1.html.

Web site: wi.gov

SPECIAL STAMPS

COMPLETING THIS FORM

The special distinctive tribal cigarette tax stamps which

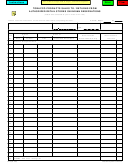

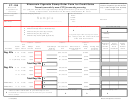

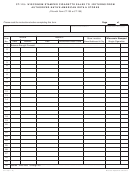

Use a single line for each transaction and provide all the

are available from the department for both 20-packs and

information requested. Group sales by authorized retail

25-packs must be affixed to all packs sold to retail stores

store and provide a subtotal for each store. Indicate a

authorized by any federally recognized Native American

subtotal on each page and a grand total on the last page.

Indian Tribe.

Each entry must be stated in terms of single cigarettes.

Do not enter number of packs or cartons.

WHEN TO COMPLETE AND FILE THIS SCHEDULE

Complete this schedule each month that you have transac-

Sales to Authorized Tribal Retailers. For each sale,

tions (sales and/or returns) with an authorized tribal retailer.

indicate the date of the sale, invoice number, tribe’s name,

Attach this schedule to the cigarette tax return that you are

name and address of the authorized retail store purchasing

required to file each month with the department (CT-100 for

the cigarettes, and the number of stamped single cigarettes

in-state permittees or CT-105 for out-of-state permittees).

sold to the authorized store covered by the invoice.

For in-state permittees filing the CT-100, this schedule

Credits (shorts/return of product by tribe). For each

is informational. For out-of-state permittees that file the

entry, indicate the credit memo/invoice number, its date,

CT-105, these sales must also be included on Schedule

tribe’s name, the name and address of the authorized retail

CT-101, Schedule 6, Tax-Paid Sales as part of Wisconsin

store credited, and the number of stamped single cigarettes

sales. Out-of-state permittees should transfer the total on

returned or shorted. Place parenthesis (

) around the

line 30 to their CT-101, Schedule 6, Tax-Paid Sales. Enter

number of cigarettes returned or shorted and deduct this

the total on a line and label it “Tribal sales from CT-115.”

amount when computing the total to enter on line 30.

RECORDS

Line 30 Total. Enter the total net (sales less credits) num-

You must keep a complete copy of your return, including

ber of Wisconsin stamped single cigarettes sold during the

this schedule, and all records pertaining to your business

month to authorized tribal retail stores.

for at least four years. The records must be kept at the

permit location, and in a place and manner easily acces-

COMPUTER PRINTOUTS

sible for review by department representatives.

The department will accept computer printouts of cigarette

transactions in lieu of listing individual sales/returns on this

ASSISTANCE

schedule. If submitting computer listings:

You can access the department’s web site 24 hours a day,

seven days a week, at wi.gov. From this web

1.

Use this form as a summary sheet for the accompany-

site, you can:

ing printouts. Complete the top portion of this form,

indicate “see attached” on line 1, and enter the net

• Complete electronic fill-in forms

total of all Wisconsin tribal sales/returns on line 30.

• Download forms, schedules instructions, and

2.

Prepare your computer printouts using the same

publications

format and columnar sequence as on this form.

• View answers to frequently asked questions

Group sales/returns by retail store on your printout

• E-mail us comments or request help

(if possible) and provide a net total for each store.

• Access My Tax Account

If you are unable to duplicate this format, submit a

proposed format for our review. We will let you know

if it is satisfactory or what changes will be required.

3.

Use paper 8½ X 11 inches.

1

1 2

2