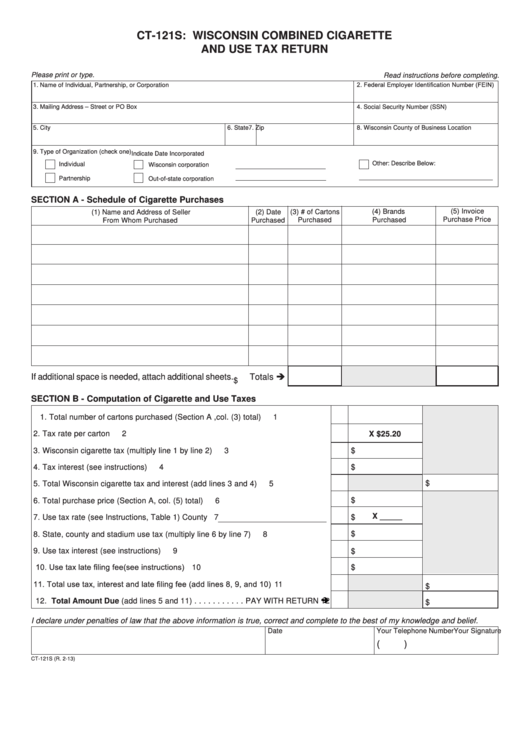

CT-121S: WISCONSIN COMBINED CIGARETTE

AND USE TAX RETURN

Please print or type.

Read instructions before completing.

2. Federal Employer Identification Number (FEIN)

1. Name of Individual, Partnership, or Corporation

3. Mailing Address – Street or PO Box

4. Social Security Number (SSN)

5. City

6. State

7. Zip

8. Wisconsin County of Business Location

9. Type of Organization (check one)

Indicate Date Incorporated

Other: Describe Below:

Individual

Wisconsin corporation

Partnership

Out-of-state corporation

SECTION A - Schedule of Cigarette Purchases

(5) Invoice

(1) Name and Address of Seller

(2) Date

(3) # of Cartons

(4) Brands

Purchase Price

From Whom Purchased

Purchased

Purchased

Purchased

Totals

If additional space is needed, attach additional sheets.

$

SECTION B - Computation of Cigarette and Use Taxes

1. Total number of cartons purchased (Section A ,col. (3) total). . . . . . . . . . . . . . .

1

2. Tax rate per carton . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

X $25.20

3. Wisconsin cigarette tax (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . .

3

$

4. Tax interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

$

$

5. Total Wisconsin cigarette tax and interest (add lines 3 and 4) . . . . . . . . . . . . . .

5

$

6. Total purchase price (Section A, col. (5) total) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

X _____

7. Use tax rate (see Instructions, Table 1) County

7

$

$

8. State, county and stadium use tax (multiply line 6 by line 7) . . . . . . . . . . . . . . .

8

9. Use tax interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

$

10. Use tax late filing fee(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$

11. Total use tax, interest and late filing fee (add lines 8, 9, and 10) . . . . . . . . . . . .

11

$

12. Total Amount Due (add lines 5 and 11) . . . . . . . . . . . PAY WITH RETURN

12

$

I declare under penalties of law that the above information is true, correct and complete to the best of my knowledge and belief.

Your Signature

Date

Your Telephone Number

(

)

CT-121S (R. 2-13)

1

1 2

2