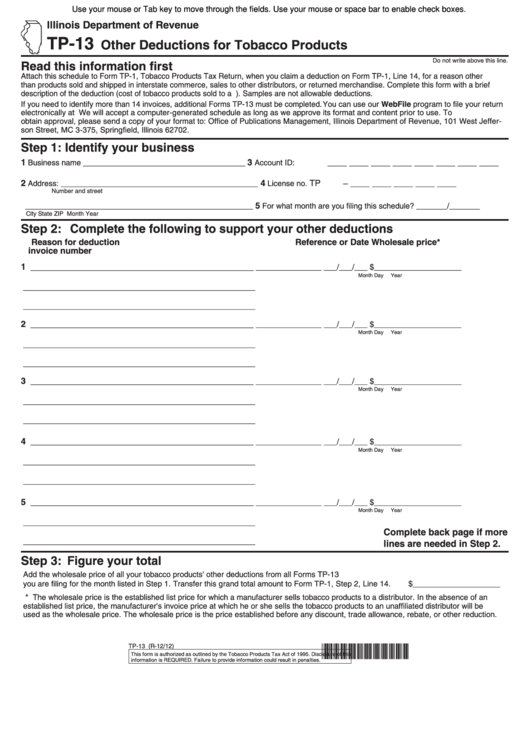

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

TP-13

Other Deductions for Tobacco Products

Do not write above this line.

Read this information first

Attach this schedule to Form TP-1, Tobacco Products Tax Return, when you claim a deduction on Form TP-1, Line 14, for a reason other

than products sold and shipped in interstate commerce, sales to other distributors, or returned merchandise. Complete this form with a brief

description of the deduction (i.e. cost of tobacco products sold to a U.S. government agency). Samples are not allowable deductions.

If you need to identify more than 14 invoices, additional Forms TP-13 must be completed. You can use our WebFile program to file your return

electronically at tax.illinois.gov. We will accept a computer-generated schedule as long as we approve its format and content prior to use. To

obtain approval, please send a copy of your format to: Office of Publications Management, Illinois Department of Revenue, 101 West Jeffer-

son Street, MC 3-375, Springfield, Illinois 62702.

Step 1: Identify your business

1

3

Business name

_____________________________________

Account ID: ____ ____ ____ ____ ____ ____ ____ ____

2

4

TP

Address: _____________________________________________

License no.

– ____ ____ ____ ____ ____

Number and street

5

____________________________________________________

For what month are you filing this schedule?

_______/_______

City

State

ZIP

Month

Year

Step 2: Complete the following to support your other deductions

Reason for deduction

Reference or

Date

Wholesale price*

invoice number

1 _______________________________________________

_______________ ___/___/___

$____________________

Month Day

Year

_____________________________________________________

_____________________________________________________

2 _______________________________________________

_______________ ___/___/___

$____________________

Month Day

Year

_____________________________________________________

_____________________________________________________

3 _______________________________________________

_______________ ___/___/___

$____________________

Month Day

Year

_____________________________________________________

_____________________________________________________

4 _______________________________________________

_______________ ___/___/___

$____________________

Month Day

Year

_____________________________________________________

_____________________________________________________

5 _______________________________________________

_______________ ___/___/___

$____________________

Month Day

Year

_____________________________________________________

Complete back page if more

_____________________________________________________

lines are needed in Step 2.

Step 3: Figure your total

Add the wholesale price of all your tobacco products' other deductions from all Forms TP-13

you are filing for the month listed in Step 1. Transfer this grand total amount to Form TP-1, Step 2, Line 14.

$____________________

* The wholesale price is the established list price for which a manufacturer sells tobacco products to a distributor. In the absence of an

established list price, the manufacturer's invoice price at which he or she sells the tobacco products to an unaffiliated distributor will be

used as the wholesale price. The wholesale price is the price established before any discount, trade allowance, rebate, or other reduction.

TP-13 (R-12/12)

*240501110*

This form is authorized as outlined by the Tobacco Products Tax Act of 1995. Disclosure of this

information is REQUIRED. Failure to provide information could result in penalties.

1

1 2

2