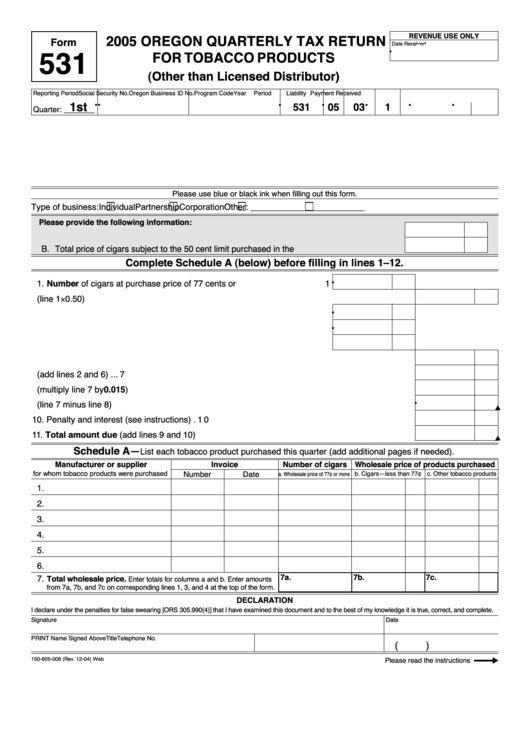

REVENUE USE ONLY

2005 OREGON QUARTERLY TAX RETURN

Form

Date Received

Clear Form

•

531

FOR TOBACCO PRODUCTS

(Other than Licensed Distributor)

Reporting Period

Social Security No.

Oregon Business ID No.

Program Code Year

Period

Liability Payment Received

•

•

•

•

•

•

•

1st

531

05

03

1

Quarter: _______

Please use blue or black ink when filling out this form.

Type of business:

Individual

Partnership

Corporation

Other: ________________________

Please provide the following information:

A. Total price of all tobacco products purchased in the quarter ...................................................

B. Total price of cigars subject to the 50 cent limit purchased in the quarter ..................................

Complete Schedule A (below) before filling in lines 1–12.

•

1. Number of cigars at purchase price of 77 cents or more ........................... 1

2. Multiply the number of cigars by 50 cents (line 1 × 0.50) ............................................................ 2

•

3. Purchase price of cigars at purchase price of less than 77 cents ............ 3

•

4. Purchase price of all other tobacco products ........................................... 4

5. Total of lines 3 and 4 ................................................................................. 5

6. Multiply line 5 by 0.65 .................................................................................................................. 6

7. Total quarterly tax (add lines 2 and 6) ......................................................................................... 7

8. Quarterly tax discount (multiply line 7 by 0.015) .......................................................................... 8

•

9. Net tax due (line 7 minus line 8) .................................................................................................. 9

10. Penalty and interest (see instructions) ...................................................................................... 10

11. Total amount due (add lines 9 and 10) .................................................................................... 11

Schedule A—

List each tobacco product purchased this quarter (add additional pages if needed).

Manufacturer or supplier

Invoice

Number of cigars

Wholesale price of products purchased

for whom tobacco products were purchased

Number

Date

b. Cigars—less than 77¢

c. Other tobacco products

a. Wholesale price of 77¢ or more

1.

2.

3.

4.

5.

6.

7a.

7b.

7c.

7.

Total wholesale price.

Enter totals for columns a and b. Enter amounts

from 7a, 7b, and 7c on corresponding lines 1, 3, and 4 at the top of the form.

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowledge it is true, correct, and complete.

Signature

Date

PRINT Name Signed Above

Title

Telephone No.

(

)

150-605-006 (Rev. 12-04) Web

Please read the instructions

1

1 2

2 3

3 4

4 5

5