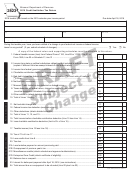

Description (Do not list tangible personal property tax on leased property)

Amount

Total (Enter on Lines 8 and 19, Page 1)

1. List all Missouri offices or locations for which this return is made. Indicate the complete address of each office or location.

Include the percentage of gross income of each office or location to the total income of the company in Missouri. (Attach a

separate page if additional space is needed.)

2. Is this return made on the basis of actual receipts and disbursements? If not, describe fully what other basis or method

was used in computing net income.

3. What is the principal source of income?

4. If the business is a pawnbroker, what percent of the total business is your loan business?

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any

r

r

member of his or her firm, or if internally prepared, any member of the internal staff ............................................

Yes

No

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, complete, and correct. Declaration of preparer (other than taxpayer) is based on

all information of which he or she has any knowledge.

Signature of Officer (Required)

Title of Officer

Phone Number

Date (MM/DD/YYYY)

(

)

-

__ __ /__ __ /__ __ __ __

___ ___ ___

___ ___ ___

___ ___ ___ ___

Preparer’s Signature (Including Internal Preparer) Preparer’s FEIN, SSN, or PTIN Phone Number

Date (MM/DD/YYYY)

(

)

-

__ __ /__ __ /__ __ __ __

___ ___ ___

___ ___ ___

___ ___ ___ ___

Make check or money order payable to “Missouri Department of Revenue”. Mail completed form and attachments to the address below.

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any returned check may be presented

again electronically.

Form 2823 (Revised 12-2013)

Mail to:

Phone: (573) 751-2326

Taxation Division

Fax: (573) 522-1721

P.O. Box 898

Visit

TDD: (800) 735-2966

Jefferson City, MO 65105-0898

for additional information.

E-mail: fit@dor.mo.gov

1

1 2

2