High-Technology Investment Tax Credit Worksheet - 2001

ADVERTISEMENT

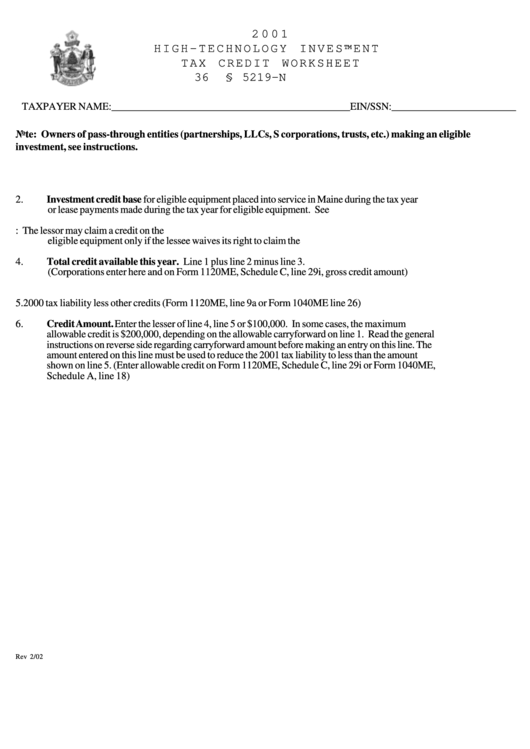

2 0 0 1

H I G H - T E C H N O L O G Y I N V E S T M E N T

T A X C R E D I T W O R K S H E E T

36 M.R.S.A. § 5219-N

TAXPAYER NAME:______________________________________________EIN/SSN:________________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions.

1.

Carryforward from previous year................................................................................................... _______________

2.

Investment credit base for eligible equipment placed into service in Maine during the tax year

or lease payments made during the tax year for eligible equipment. See instructions........................ _______________

3.

Less lease payments received during the tax year. Note: The lessor may claim a credit on the

eligible equipment only if the lessee waives its right to claim the credit.............................................. _______________

4.

Total credit available this year. Line 1 plus line 2 minus line 3.

(Corporations enter here and on Form 1120ME, Schedule C, line 29i, gross credit amount)........... _______________

5.

2000 tax liability less other credits (Form 1120ME, line 9a or Form 1040ME line 26).................... _______________

6.

Credit Amount. Enter the lesser of line 4, line 5 or $100,000. In some cases, the maximum

allowable credit is $200,000, depending on the allowable carryforward on line 1. Read the general

instructions on reverse side regarding carryforward amount before making an entry on this line. The

amount entered on this line must be used to reduce the 2001 tax liability to less than the amount

shown on line 5. (Enter allowable credit on Form 1120ME, Schedule C, line 29i or Form 1040ME,

Schedule A, line 18)...................................................................................................................... _______________

Rev 2/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1