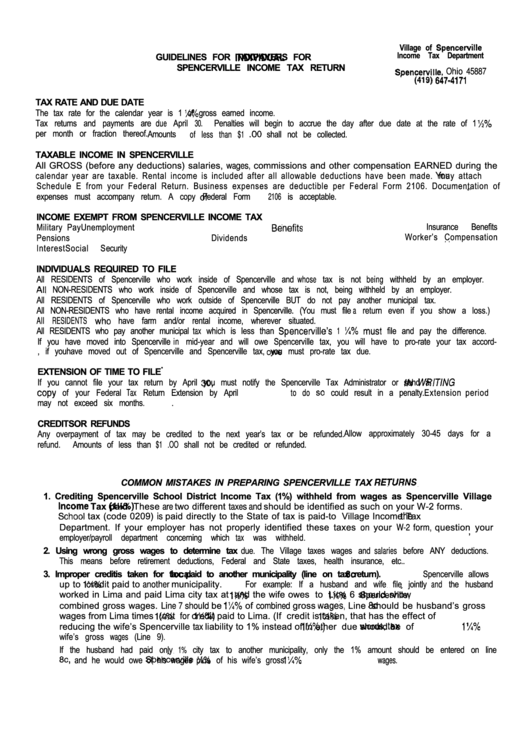

Guidelines For Individual Taxpayers For Spencerville Income Tax Return

ADVERTISEMENT

Village of

Income Tax Department

GUIDELINES FOR

TAXPAYERS FOR

P.O. Box 57

SPENCERVILLE INCOME TAX RETURN

Ohio 45887

TAX RATE AND DUE DATE

The tax rate for the calendar year is 1

of gross earned income.

Tax returns and payments are due April 30.

Penalties will begin to accrue the day after due date at the rate of 1

per month or fraction thereof. Amounts of less than $1

shall not be collected.

TAXABLE INCOME IN SPENCERVILLE

All GROSS (before any deductions) salaries, wages, commissions and other compensation EARNED during the

calendar year are taxable. Rental income is included after all allowable deductions have been made.

may attach

Schedule E from your Federal Return. Business expenses are deductible per Federal Form 2106. Documentation of

.

Federal Form 2106 is acceptable.

expenses must accompany return. A copy

INCOME EXEMPT FROM SPENCERVILLE INCOME TAX

Insurance

Benefits

Military Pay

Unemployment

Worker’s Compensation

Pensions

Dividends

Interest

Social

Security

INDIVIDUALS REQUIRED TO FILE

All RESIDENTS of Spencerville who work inside of Spencerville and whose tax is not being withheld by an employer.

NON-RESIDENTS who work inside of Spencerville and whose tax is not, being withheld by an employer.

All RESIDENTS of Spencerville who work outside of Spencerville BUT do not pay another municipal tax.

All NON-RESIDENTS who have rental income acquired in Spencerville. (You must file a return even if you show a loss.)

All RESIDENTS

have farm and/or rental income, wherever situated.

All RESIDENTS who pay another municipal tax which is less than

1

file and pay the difference.

If you have moved into Spencerville in mid-year and will owe Spencerville tax, you will have to pro-rate your tax accord-

ingly.

Likewise, if you have moved out of Spencerville and

Spencerville tax, you must pro-rate tax due.

.

EXTENSION OF TIME TO FILE

If you cannot file your tax return by April

you must notify the Spencerville Tax Administrator

or send a

of your Federal Tax Return Extension by April 30. Failure to do

could result in a penalty.

Extension period

may not exceed six months.

.

CREDITS OR REFUNDS

Allow approximately 30-45 days for a

Any overpayment of tax may be credited to the next year’s tax or be refunded.

Amounts of less than $1 .OO shall not be credited or refunded.

refund.

COMMON MISTAKES IN PREPARING SPENCERVILLE TAX

1. Crediting Spencerville School District Income Tax (1%) withheld from wages as Spencerville Village

paid. These are two different taxes and should be identified as such on your W-2 forms.

Tax

tax (code 0209) is paid directly to the State of Ohio.

Village tax is paid-to

Village Income Tax

Department. If your employer has not properly identified these taxes on your W-2 form, question your

,

employer/payroll department concerning which tax was withheld.

2. Using wrong gross wages to determine tax due. The Village taxes wages and salaries before ANY deductions.

This means before retirement deductions, Federal and State taxes, health insurance, etc..

3. Improper credit is taken for

tax paid to another municipality (line

on tax return). Spencerville allows

credit paid to another municipality. For example: If a husband and wife file jointly and the husband

up to

worked in Lima and paid Lima city tax at

and the wife owes

to

Line 6 should show

combined gross wages. Line 7 should be

of combined gross

Line

should be husband’s gross

for credit paid to Lima. (If

wages from Lima times

(not

credit is taken, that has the effect of

reducing the wife’s Spencerville tax liability to 1% instead of

In other

due should be

of

wife’s gross wages (Line 9).

If the husband had paid only 1% city tax to another municipality, only the 1% amount should be entered on line

of his wife’s gross wages.

and he would owe

of his wages plus

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3