Form St-21 - Instructions For Sales And Use Tax Refund Application

ADVERTISEMENT

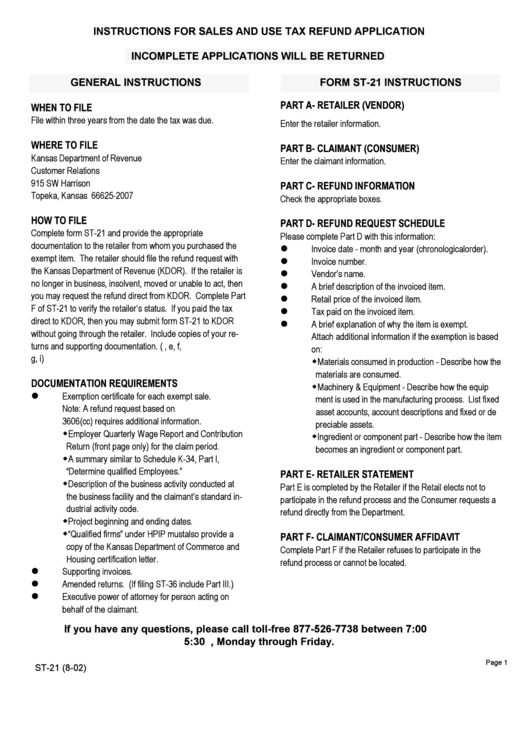

INSTRUCTIONS FOR SALES AND USE TAX REFUND APPLICATION

INCOMPLETE APPLICATIONS WILL BE RETURNED

GENERAL INSTRUCTIONS

FORM ST-21 INSTRUCTIONS

PART A- RETAILER (VENDOR)

WHEN TO FILE

File within three years from the date the tax was due.

Enter the retailer information.

WHERE TO FILE

PART B- CLAIMANT (CONSUMER)

Kansas Department of Revenue

Enter the claimant information.

Customer Relations

915 SW Harrison

PART C- REFUND INFORMATION

Topeka, Kansas 66625-2007

Check the appropriate boxes.

HOW TO FILE

PART D- REFUND REQUEST SCHEDULE

Complete form ST-21 and provide the appropriate

Please complete Part D with this information:

documentation to the retailer from whom you purchased the

l

Invoice date - month and year (chronologicalorder).

exempt item. The retailer should file the refund request with

l

Invoice number.

the Kansas Department of Revenue (KDOR). If the retailer is

l

Vendor’s name.

no longer in business, insolvent, moved or unable to act, then

l

A brief description of the invoiced item.

you may request the refund direct from KDOR. Complete Part

l

Retail price of the invoiced item.

F of ST-21 to verify the retailer’s status. If you paid the tax

l

Tax paid on the invoiced item.

direct to KDOR, then you may submit form ST-21 to KDOR

l

A brief explanation of why the item is exempt.

without going through the retailer. Include copies of your re-

Attach additional information if the exemption is based

turns and supporting documentation. (K.A.R.. 91-19-49a, e, f,

on:

g, i)

w

Materials consumed in production - Describe how the

materials are consumed.

DOCUMENTATION REQUIREMENTS

w

Machinery & Equipment - Describe how the equip

l

Exemption certificate for each exempt sale.

ment is used in the manufacturing process. List fixed

Note: A refund request based on K.S.A. 79-

asset accounts, account descriptions and fixed or de

3606(cc) requires additional information.

preciable assets.

w

Employer Quarterly Wage Report and Contribution

w

Ingredient or component part - Describe how the item

Return (front page only) for the claim period.

becomes an ingredient or component part.

w

A summary similar to Schedule K-34, Part I,

“Determine qualified Employees.”

PART E- RETAILER STATEMENT

w

Description of the business activity conducted at

Part E is completed by the Retailer if the Retail elects not to

the business facility and the claimant’s standard in-

participate in the refund process and the Consumer requests a

dustrial activity code.

refund directly from the Department.

w

Project beginning and ending dates.

w

“Qualified firms” under HPIP must also provide a

PART F- CLAIMANT/CONSUMER AFFIDAVIT

copy of the Kansas Department of Commerce and

Complete Part F if the Retailer refuses to participate in the

Housing certification letter.

refund process or cannot be located.

l

Supporting invoices.

l

Amended returns. (If filing ST-36 include Part III.)

l

Executive power of attorney for person acting on

behalf of the claimant.

If you have any questions, please call toll-free 877-526-7738 between 7:00 a.m. and

5:30 p.m., Monday through Friday.

Page 1

ST-21 (8-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1