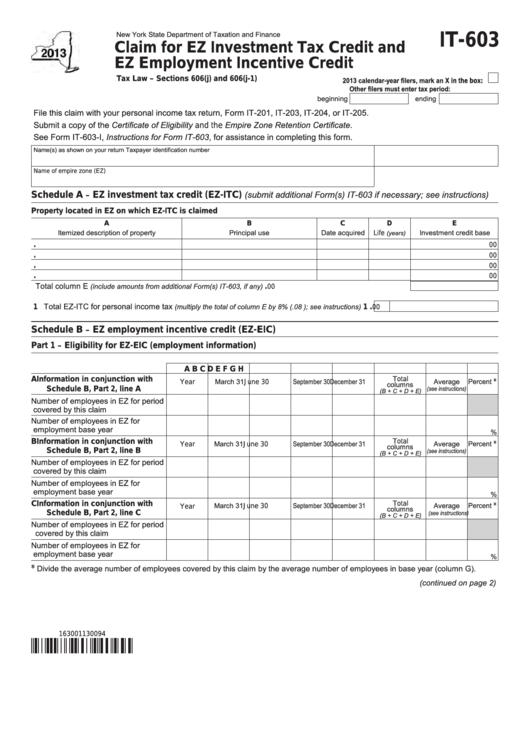

New York State Department of Taxation and Finance

IT-603

Claim for EZ Investment Tax Credit and

EZ Employment Incentive Credit

Tax Law – Sections 606(j) and 606(j-1)

2013 calendar‑year filers, mark an X in the box:

Other filers must enter tax period:

beginning

ending

File this claim with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Submit a copy of the Certificate of Eligibility and the Empire Zone Retention Certificate.

See Form IT-603-I, Instructions for Form IT‑603, for assistance in completing this form.

Name(s) as shown on your return

Taxpayer identification number

Name of empire zone (EZ)

(submit additional Form(s) IT‑603 if necessary; see instructions)

Schedule A

EZ investment tax credit (EZ-ITC)

–

Property located in EZ on which EZ-ITC is claimed

A

B

C

D

E

Itemized description of property

Principal use

Date acquired

Investment credit base

(years)

Life

.

00

.

00

.

00

.

00

Total column E

..............................................................

(include amounts from additional Form(s) IT‑603, if any)

.

00

1 Total EZ-ITC for personal income tax

....

(multiply the total of column E by 8% (.08 ); see instructions)

.

1

00

Schedule B

EZ employment incentive credit (EZ-EIC)

–

Part 1

Eligibility for EZ-EIC (employment information)

–

A

B

C

D

E

F

G

H

Total

A Information in conjunction with

March 31

September 30 December 31

Average

Percent

*

Year

June 30

columns

(see instructions)

Schedule B, Part 2, line A

(B + C + D + E)

Number of employees in EZ for period

covered by this claim

Number of employees in EZ for

employment base year

%

Total

B Information in conjunction with

March 31

September 30 December 31

Average

Percent

*

Year

June 30

columns

Schedule B, Part 2, line B

(see instructions)

(B + C + D + E)

Number of employees in EZ for period

covered by this claim

Number of employees in EZ for

employment base year

%

C Information in conjunction with

Total

March 31

September 30 December 31

Average

Percent

*

June 30

Year

columns

(see instructions)

Schedule B, Part 2, line C

(B + C + D + E)

Number of employees in EZ for period

covered by this claim

Number of employees in EZ for

employment base year

%

Divide the average number of employees covered by this claim by the average number of employees in base year (column G).

*

(continued on page 2)

163001130094

1

1 2

2 3

3 4

4