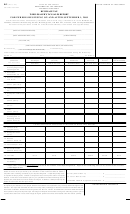

Form R-1 - Manufacturer'S Tax Sales Report For Periods Beginning On And After September 1, 2009 Page 2

ADVERTISEMENT

R-1

(Rev 9/09)

Page 2

REPORT CONTENTS (See Instruction)

SCH. “A” _______________________ SHEETS

SCH. “F” _______________________

SCH. “J” ________________________ SHEETS

SCH. “B” _______________________ SHEETS

SCH. “H” _______________________

SCH. “BW” ______________________ SHEETS

SCH. “C” _______________________ SHEETS

AFFIDAVITS . . . . . . . . . . . . . . . . . . . . . . . . ._______________________________________

SCH. “D” _______________________ SHEETS

CERTIFICATES OF NON-BEVERAGE USE _______________________________________

SCH. “E” _______________________ SHEETS

BEVERAGE TAX CREDIT MEMOS . . . . . . ._______________________________________

OTHER (___________________________) ._______________________________________

I certify under the penalties provided by law, including license suspension or revocation, that this report (including any accompanying schedules and

statement(s)) has been examined by me and is true, correct and complete. I also certify that I am the person authorized to certify this report.

___________________________________________________

(_______)_____________________

____________________

SIGNATURE OF LICENSEE OR AUTHORIZED AGENT

PHONE

DATE

________________________________________ (_______)_________________ ________________________ ____________________

SIGNATURE OF INDIVIDUAL OR FIRM, PREPARING RETURN

PHONE

FEDERAL IDENTIFICATION NUMBER

DATE

PENALTIES FOR FAILURE TO FILE REPORT, OR FILING OF FALSE OR FRAUDULENT REPORT.

Any person who shall fail to file any report required to be filed pursuant to the provisions of this title, or shall file or cause to be filed, with the Director, any

false or fraudulent report or statement, or shall aid or abet another in the filing with the Director, any false or fraudulent report or statement, with the intent to

defraud the State or evade the payment of any tax, penalty or interest or any part thereof, which shall be due pursuant to the provisions of this title, shall be

punished in accordance with the State Tax Uniform Procedure Law, R.S. 54:48-1 et seq.

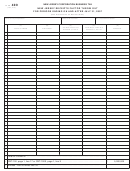

List under separate headings by accounts,non-taxable sales and “returns made” to places in New Jersey during the

SCHEDULE “A”

period of _____________________ and ______________________, (year) ___________ (See Instructions).

Beer and Malt

Liquors

Sparkling

Apple Cider*

Name, address and License Number

*

Beverages

(Alcohol)

Still Wines

Vermouth

Wines

(3.2% to 7% Alcohol)

of Purchaser and Consignee

Total Gals.

Total Wine Gals.

Total Wine Gals.

Total Wine Gals. Total Wine Gals.

Total Wine Gals.

*

more than 7%

Apple Cider containing

alcohol to be included under Sparkling Wines. Apple Cider containing 3.2% to 7% alcohol to be

included under Apple Cider.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2