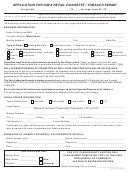

Form 70-014 - Application For Iowa Retail Cigarette / Tobacco Permit Page 2

ADVERTISEMENT

Instructions for Iowa Retail Cigarette / Tobacco Permit Application

(MUST BE PRINTED CLEARLY OR TYPED)

Cigarettes must be sold at the minimum price set by the State of Iowa. Obtain a current copy

of the minimum price list from the Iowa Department of Revenue Web site at

(click on Forms, select Cigarette/Tobacco, select Forms).

__________________________________________________________

ONLY APPROVED BRANDS OF CIGARETTES OR ROLL-YOUR-OWN PRODUCTS MAY BE SOLD IN IOWA

Any brand not on the list is contraband. In

The list of approved brands is always current at

addition, all cigarettes sold in Iowa must have

an Iowa Cigarette Tax Stamp affixed to each

and is called

package. Any violation of contraband or non-

Iowa cigarette tax stamped package is subject

IOWA DIRECTORY OF CERTIFIED TOBACCO

to seizure and penalties under the provisions of

PRODUCTS MANUFACTURERS —

THEIR BRANDS AND BRAND FAMILIES

Iowa Code 453A and 453D.

A new application must be submitted every year.

All retailers need to sign up for the Cigarette/

A permit will not be issued until the application is

Tobacco eList (listserv).

properly completed.

You will receive an e-mail every time the

approved list changes or the minimum price list

Fill in the month, day and year that this application

changes.

covers.

Go to

All permits expire June 30th. Normally this period will

be the Fiscal Year July 1st through June 30th.

BUSINESS INFORMATION

Fill in the name the business is known by - DBA (doing business as).

Fill in the REQUIRED location and mailing address, city, and zip where the business is actually located;

that is, the 911 address. Add the post office box if required for mail delivery.

Check whether the cigarettes will be sold through a vending machine or over the counter.

Fill in the 10-digit telephone number of the business.

Check one type of retail establishment; that is, bar, convenience store-no gas, convenience-with gas, drug, gas

station, grocery, hotel/motel, liquor store, restaurant, tobacco store, other. If “other,” please write in type.

LEGAL OWNER INFORMATION

Check whether the legal ownership of the business is individual, a partnership, a corporation, a Limited

Liability Corporation (LLC), or a Limited Liability Partnership (LLP).

Fill in the name of the individual, the partnership, the corporation, the LLC, or the LLP that is the legal owner

of the business. This is NOT the store manager or corporate president.

Fill in the mailing address, post office box (if required for mail delivery), city, state, zip and telephone

number of the above named legal owner.

Fill in the fax number and e-mail address of the legal owner.

Print the name of the individual owner, partner(s) or corporate official signing this application.

Sign and date the application. The application must be signed by the owner, one of the partners, or one of the

corporate officers listed above. A preparer’s or store manager’s signature is not acceptable unless he or she is

one of the owners, partners, or corporate officers.

Return this application to your local jurisdiction: city clerk (within city limits)

or county auditor (outside city limits).

70-014b (05/30/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2