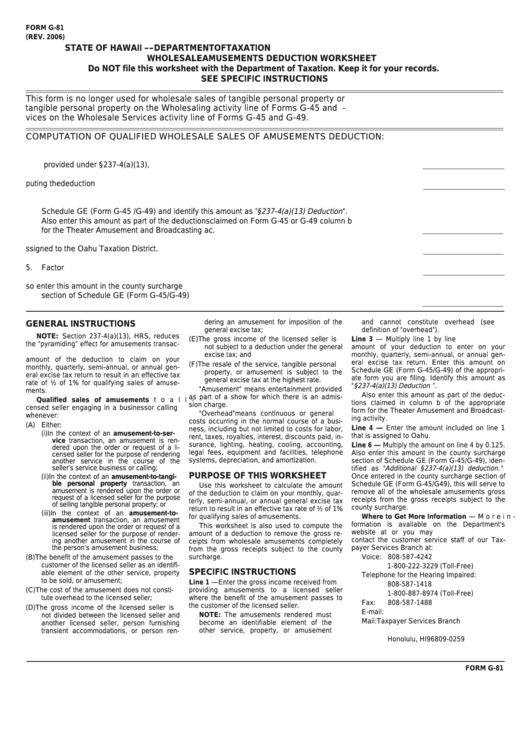

FORM G-81

(REV. 2006)

STATE OF HAWAII –– DEPARTMENT OF TAXATION

WHOLESALE AMUSEMENTS DEDUCTION WORKSHEET

Do NOT file this worksheet with the Department of Taxation. Keep it for your records.

SEE SPECIFIC INSTRUCTIONS

This form is no longer used for wholesale sales of tangible personal property or services. Report wholesales sales of

tangible personal property on the Wholesaling activity line of Forms G-45 and G-49. Report wholesale sales of ser-

vices on the Wholesale Services activity line of Forms G-45 and G-49.

COMPUTATION OF QUALIFIED WHOLESALE SALES OF AMUSEMENTS DEDUCTION:

1.

Total gross income received from qualified sales of amusements at wholesale as

provided under §237-4(a)(13), HRS...............................................................................................................

2.

Rate used for computing the deduction .........................................................................................................

.875

3.

Multiply line 1 by line 2. This is your maximum allowable deduction. Enter this amount on

Schedule GE (Form G-45 /G-49) and identify this amount as “ §237-4(a)(13) Deduction ”.

Also enter this amount as part of the deductions claimed on Form G-45 or G-49 column b

for the Theater Amusement and Broadcasting activity. ..................................................................................

4.

Enter the amount included on line 1 that is assigned to the Oahu Taxation District. ...................................

5.

Factor ..............................................................................................................................................................

0.125

6.

Multiply the amount on line 4 by 0.125. Also enter this amount in the county surcharge

section of Schedule GE (Form G-45/G-49).....................................................................................................

dering an amusement for imposition of the

and cannot constitute overhead (see

GENERAL INSTRUCTIONS

general excise tax;

definition of “overhead”).

NOTE: Section 237-4(a)(13), HRS, reduces

(E) The gross income of the licensed seller is

Line 3 — Multiply line 1 by line 2. This is the

the “pyramiding” effect for amusements transac-

not subject to a deduction under the general

amount of your deduction to enter on your

tions.

Use this worksheet to calculate the

excise tax; and

monthly, quarterly, semi-annual, or annual gen-

amount of the deduction to claim on your

eral excise tax return. Enter this amount on

(F) The resale of the service, tangible personal

monthly, quarterly, semi-annual, or annual gen-

Schedule GE (Form G-45/G-49) of the appropri-

property, or amusement is subject to the

eral excise tax return to result in an effective tax

ate form you are filing. Identify this amount as

general excise tax at the highest rate.

rate of ½ of 1% for qualifying sales of amuse-

“ §237-4(a)(13) Deduction ”.

“Amusement” means entertainment provided

ments.

Also enter this amount as part of the deduc-

as part of a show for which there is an admis-

Qualified sales of amusements to a li-

tions claimed in column b of the appropriate

sion charge.

censed seller engaging in a business or calling

form for the Theater Amusement and Broadcast-

“Overhead”

means continuous or general

whenever:

ing activity.

costs occurring in the normal course of a busi-

(A) Either:

Line 4 — Enter the amount included on line 1

ness, including but not limited to costs for labor,

(i) In the context of an amusement-to-ser-

that is assigned to Oahu.

rent, taxes, royalties, interest, discounts paid, in-

vice transaction, an amusement is ren-

surance, lighting, heating, cooling, accounting,

Line 6 — Multiply the amount on line 4 by 0.125.

dered upon the order or request of a li-

legal fees, equipment and facilities, telephone

Also enter this amount in the county surcharge

censed seller for the purpose of rendering

systems, depreciation, and amortization.

section of Schedule GE (Form G-45/G-49), iden-

another service in the course of the

seller’s service business or calling;

tified as " Additional §237-4(a)(13) deduction. "

PURPOSE OF THIS WORKSHEET

Once entered in the county surcharge section of

(ii) In the context of an amusement-to-tangi-

ble personal property transaction, an

Schedule GE (Form G-45/G49), this will serve to

Use this worksheet to calculate the amount

amusement is rendered upon the order or

remove all of the wholesale amusements gross

of the deduction to claim on your monthly, quar-

request of a licensed seller for the purpose

receipts from the gross receipts subject to the

terly, semi-annual, or annual general excise tax

of selling tangible personal property; or

county surcharge.

return to result in an effective tax rate of ½ of 1%

(iii) In the context of an amusement-to-

for qualifying sales of amusements.

Where to Get More Information — More in-

amusement transaction, an amusement

formation is available on the Department's

This worksheet is also used to compute the

is rendered upon the order or request of a

website at or you may

amount of a deduction to remove the gross re-

licensed seller for the purpose of render-

contact the customer service staff of our Tax-

ing another amusement in the course of

ceipts from wholesale amusements completely

the person’s amusement business;

payer Services Branch at:

from the gross receipts subject to the county

surcharge.

Voice: 808-587-4242

(B) The benefit of the amusement passes to the

customer of the licensed seller as an identifi-

1-800-222-3229 (Toll-Free)

SPECIFIC INSTRUCTIONS

able element of the other service, property

Telephone for the Hearing Impaired:

to be sold, or amusement;

Line 1 — Enter the gross income received from

808-587-1418

(C) The cost of the amusement does not consti-

providing amusements to a licensed seller

1-800-887-8974 (Toll-Free)

where the benefit of the amusement passes to

tute overhead to the licensed seller;

Fax:

808-587-1488

the customer of the licensed seller.

(D) The gross income of the licensed seller is

E-mail: Taxpayer.Services@hawaii.gov

not divided between the licensed seller and

NOTE: The amusements rendered must

Mail:

Taxpayer Services Branch

become an identifiable element of the

another licensed seller, person furnishing

P.O. Box 259

transient accommodations, or person ren-

other service, property, or amusement

Honolulu, HI 96809-0259

FORM G-81

1

1