Form St-P-70 - Industrial Users Blanket Certificate Of Exemption

ADVERTISEMENT

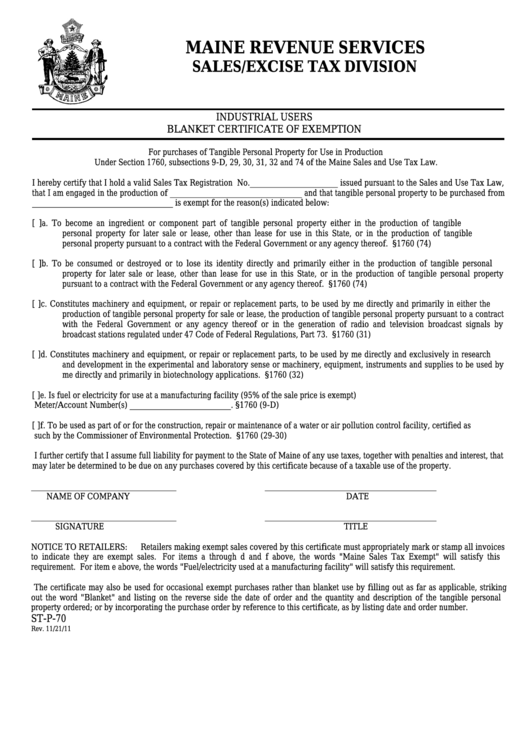

MAINE REVENUE SERVICES

SALES/EXCISE TAX DIVISION

INDUSTRIAL USERS

BLANKET CERTIFICATE OF EXEMPTION

For purchases of Tangible Personal Property for Use in Production

Under Section 1760, subsections 9-D, 29, 30, 31, 32 and 74 of the Maine Sales and Use Tax Law.

I hereby certify that I hold a valid Sales Tax Registration No.____________________ issued pursuant to the Sales and Use Tax Law,

that I am engaged in the production of ______________________________ and that tangible personal property to be purchased from

________________________________ is exempt for the reason(s) indicated below:

[ ]a.

To become an ingredient or component part of tangible personal property either in the production of tangible

personal property for later sale or lease, other than lease for use in this State, or in the production of tangible

personal property pursuant to a contract with the Federal Government or any agency thereof. §1760 (74)

[ ]b.

To be consumed or destroyed or to lose its identity directly and primarily either in the production of tangible personal

property for later sale or lease, other than lease for use in this State, or in the production of tangible personal property

pursuant to a contract with the Federal Government or any agency thereof. §1760 (74)

[ ]c.

Constitutes machinery and equipment, or repair or replacement parts, to be used by me directly and primarily in either the

production of tangible personal property for sale or lease, the production of tangible personal property pursuant to a contract

with the Federal Government or any agency thereof or in the generation of radio and television broadcast signals by

broadcast stations regulated under 47 Code of Federal Regulations, Part 73. §1760 (31)

[ ]d.

Constitutes machinery and equipment, or repair or replacement parts, to be used by me directly and exclusively in research

and development in the experimental and laboratory sense or machinery, equipment, instruments and supplies to be used by

me directly and primarily in biotechnology applications. §1760 (32)

[ ]e.

Is fuel or electricity for use at a manufacturing facility (95% of the sale price is exempt)

Meter/Account Number(s) _______________________. §1760 (9-D)

[ ]f.

To be used as part of or for the construction, repair or maintenance of a water or air pollution control facility, certified as

such by the Commissioner of Environmental Protection. §1760 (29-30)

I further certify that I assume full liability for payment to the State of Maine of any use taxes, together with penalties and interest, that

may later be determined to be due on any purchases covered by this certificate because of a taxable use of the property.

_________________________________

_______________________________________

NAME OF COMPANY

DATE

_________________________________

_______________________________________

SIGNATURE

TITLE

NOTICE TO RETAILERS:

Retailers making exempt sales covered by this certificate must appropriately mark or stamp all invoices

to indicate they are exempt sales. For items a through d and f above, the words "Maine Sales Tax Exempt" will satisfy this

requirement. For item e above, the words "Fuel/electricity used at a manufacturing facility" will satisfy this requirement.

The certificate may also be used for occasional exempt purchases rather than blanket use by filling out as far as applicable, striking

out the word "Blanket" and listing on the reverse side the date of order and the quantity and description of the tangible personal

property ordered; or by incorporating the purchase order by reference to this certificate, as by listing date and order number.

ST-P-70

Rev. 11/21/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1