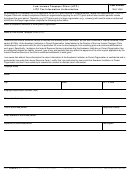

Instructions for Form 13424-A, Low Income Taxpayer Clinic (LITC)

Interim and Year-End Report General Information

Note: Form 13424-A, General Information, and Form 13424-C, Advocacy Information, must be completed by all clinics. Clinics that

operate a controversy program must also complete Form 13424-K, Controversy Case Information, and Form 13424-B, Controversy

Issues.

When submitting your Interim and Year-End Reports, include this form as part of the Program Narrative. Interim Report and Year-End

Report requirements are described in Publication 3319, section III.B.i and III.B.ii, respectively.

Note: Interim and Year-End Reports (including this report form) may be released under the Freedom of Information Act (FOIA). In

response to a FOIA request, the LITC Program Office will release these reports after appropriate redactions to ensure confidentiality of

taxpayer information.

Purpose

This form is designed to capture information about certain work the clinic performed during the reporting period. This form is used to

report all outreach activities, educational activities, consultations, referrals, tax return and other document preparation, volunteer

activities, and professional education activities conducted during the reporting period.

The Program Office uses the information reported on this form and the other reporting forms to determine the scope of services

provided by clinics. Data is also aggregated to provide program-wide statistical information about services provided to low income and

English as a Second Language (ESL) taxpayers. Please be careful to follow the instructions for this form and to report all information

completely and accurately. If additional room is necessary to provide details about the activities reported on this form, include such

details in the program narrative.

Reporting Requirements

Regardless of the services for which your clinic has been funded (ESL, controversy, or both), every clinic must complete all parts of

this form.

Clinic Type

Check the appropriate box to indicate if your clinic operates an ESL, a controversy program, or both.

Reporting Period

Clinics are required to report on clinic activities twice for each grant year. The grant year is January 1 through December 31 for the

year in which a grant award is received. An Interim Report is required to report activities conducted for the period from January 1

through June 30; a Year-End Report is required to report activities conducted for the entire grant year, the period from January 1

through December 31.

Specific Instructions

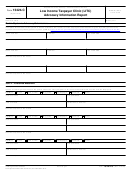

Outreach Activities

Report all outreach activities in this section. Outreach activities are efforts designed to provide information to the public about the clinic

and its services. The information may be provided directly to taxpayers or may be provided to taxpayers indirectly through other

organizations or groups that serve ESL or low income taxpayers. Examples of outreach activities include a presentation about clinic

services made to taxpayers, a campaign to distribute clinic flyers or other marketing materials to local social services organizations, or

staffing a table at a community event such as a fair, forum, or meeting to inform the public about clinic services.

Determine whether to record an outreach activity on line 1A, 1B, or 1C by looking to the primary intended audience of the activity,

rather than the actual attendees. Outreach activities primarily intended to reach ESL taxpayers should be reported on line 1A, activities

primarily intended to reach low income taxpayers in general should be reported on line 1B, and those intended for other organizations

that service ESL or low income taxpayers should be reported on line 1C. Report each outreach activity only once on line 1A, 1B, or 1C.

Note. A single outreach activity may span multiple days. For example, if a clinic staffs a booth for multiple days at a week long event,

that should be counted as one outreach activity. Additional details about the extent of such efforts can be included in the program

narrative.

Note: A campaign that involves sending the same or similar letters to multiple recipients should be counted as a single outreach

activity.

Line 1A. Report on this line the number outreach activities conducted for ESL taxpayers.

Line 1B. Report on this line the number outreach activities conducted for low income taxpayers.

Line 1C. Report on this line the number outreach activities conducted for other organizations that serve ESL or low income taxpayers.

For example, the clinic meets with board members of a local church in preparation for the church's upcoming clothing drive to benefit

the homeless. The clinic requests that the church inform low income and ESL taxpayers about the clinic's services. The clinic would

record those efforts as a single outreach activity on line 1C.

Line 1D. Report on this line the total number of outreach activities conducted during the reporting period. The number reported on this

line should equal the total of lines 1A, 1B and 1C.

13424-A

Department of the Treasury - Internal Revenue Service

Form

(Rev. 4-2012) Catalog Number 53040U

1

1 2

2 3

3 4

4 5

5