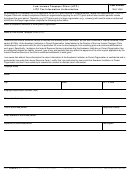

Instructions for Form 13424-A, Low Income Taxpayer Clinic (LITC)

Interim and Year-End Report General Information

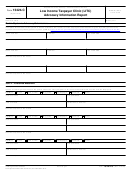

Educational Activities

Report all educational activities in this section. Educational activities are activities designed to provide information to taxpayers about

their rights and responsibilities as U.S. taxpayers, including technical tax topics. Educational activities may also be conducted for other

organizations that serve low income or ESL taxpayers. In order to be considered an educational activity, information about a specific

tax topic or topics must be conveyed to the audience. Examples of educational activities include a presentation about tax collection

issues made to taxpayers, a workshop on how to properly complete a Form W-4 for withholding, or the distribution to taxpayers of

written materials about earned income tax credit (EITC) eligibility rules.

Determine whether to record an educational activity as conducted for ESL taxpayers, low income taxpayers, or taxpayer service

providers by looking to the primary intended audience of the activity, rather than the actual attendees. Educational activities primarily

intended to reach ESL taxpayers should be reported on line 2A, activities primarily intended to reach low income taxpayers should be

reported on line 2B, and those directed towards service providers should be reported on line 2C. Record each educational activity only

once on line 2A, 2B, or 2C. Do not include any activities recorded as Outreach on lines 1A through 1D.

Line 2A. Report on this line the number of educational activities conducted for ESL taxpayers.

Line 2B. Report on this line the number of educational activities conducted for low income taxpayers.

Line 2C. Report on this line the number of educational activities conducted for other organizations that serve ESL or low income

taxpayers.

Line 2D. Report on this line the total number of educational activities conducted during the reporting period. The number reported on

this line should equal the total of lines 2A, 2B, and 2C.

Line 3A. Report on this line the total number of attendees at all educational activities conducted for ESL taxpayers during the reporting

period.

Line 3B. Report on this line the total number of attendees at all educational activities conducted for low income taxpayers during the

reporting period.

Line 3C. Report on this line the total number of attendees at all educational activities conducted for service providers during the

reporting period.

Line 3D. Report on this line the total number of attendees at all educational activities conducted during the reporting period. The

number reported on this line should equal the total of lines 3A through 3C.

Line 4. List the topics that were covered during the educational activities reported on line 2A through 2C. Do not repeat topics on

multiple lines. If a topic was repeated throughout multiple events, you may list the number of times the topic was presented. For

example, you may enter “EITC x 4” to indicate you held four presentations on the Earned Income Tax Credit during the reporting

period.

Line 5. List the languages other than English in which any educational activities were conducted.

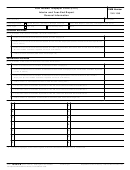

Consultations

Report all consultations in this section. A consultation is a discussion with a taxpayer designed to provide brief advice about a specific

tax matter that does not result in representation of the taxpayer. If a clinic undertakes representation of a taxpayer before a court or the

IRS, then that matter should not be reported on this form as a consultation, but rather reported as a case on Form 13424-K,

Controversy Case Information.

A technical assistance consultation is a discussion with a practitioner or other taxpayer service provider designed to give brief advice

about a tax issue. For example, if a clinic staff member addresses a tax-related question for a staff member of another legal services

organization, that communication should be counted as a technical assistance consultation.

Line 6A. Report on this line the number of consultations conducted with ESL taxpayers.

Line 6B. Report on this line the number of consultations conducted with low income taxpayers.

Line 6C. Report on this line the total number of consultations conducted with taxpayers during the reporting period. The number

reported on this line should equal the total of lines 6A and 6Bb.

Line 7. Report on this line the number of technical assistance consultations conducted with a tax practitioner or other service provider

during the reporting period.

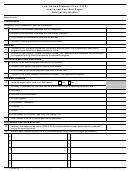

13424-A

Department of the Treasury - Internal Revenue Service

Form

(Rev. 4-2012) Catalog Number 53040U

1

1 2

2 3

3 4

4 5

5